Last Updated:

November 22, 2025

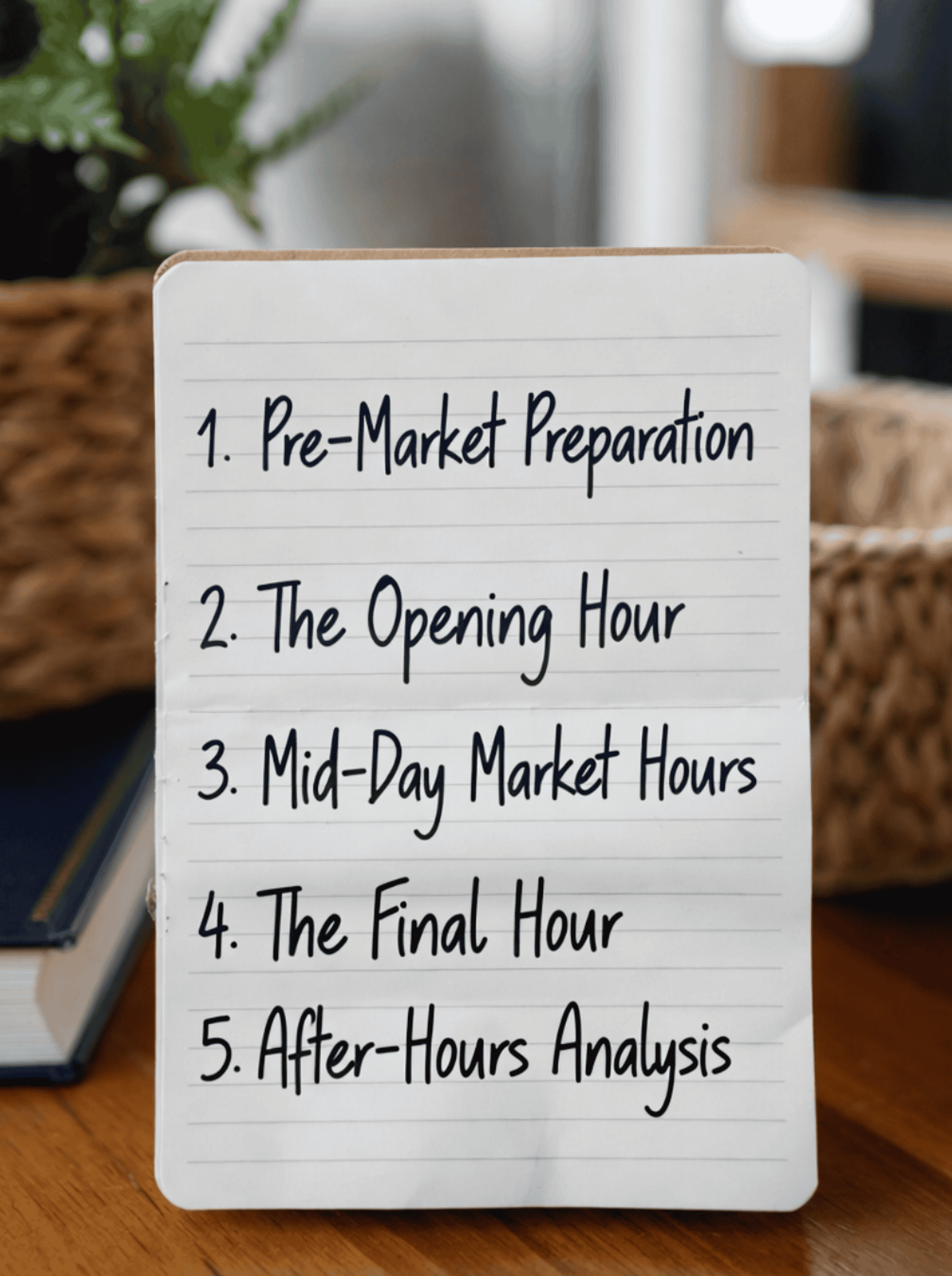

Why a Stock Trading Routine Separates Winners from Losers

Professional traders don’t rely on luck or impulse decisions. They follow a proven stock trading routine that maximizes preparation, minimizes emotion, and consistently identifies high-probability opportunities.

The difference between consistently profitable traders and those who struggle isn’t intelligence or access to information. It’s discipline.

A structured stock trading routine transforms trading from reactive guesswork into a systematic opportunity identification. When you follow a repeatable process, you eliminate any emotional decision-making during market hours and focus your energy on execution.

The Three Pillars of Effective Trading Routines:

- Preparation before the market opens to identify opportunities without time pressure

- Real-time monitoring during market hours to track developing setups and manage risk

- Post-market analysis to learn from winners and losers while building tomorrow’s watchlist

This comprehensive guide walks you through building a stock trading routine from pre-market analysis through after-hours review, using Deepvue’s institutional-grade tools to stay ahead of the market.

Pre-Market Preparation: Setting Up for Success

The most critical part of your stock trading routine happens before the opening bell. Professional traders use pre-market hours to identify stocks showing unusual activity, build focused watchlists, and establish their game plan.

This early preparation of a stock trading routine eliminates reactive trading and provides clear conviction when opportunities emerge during market hours.

Checking Overnight Market Action

Start by understanding what happened while you were sleeping. Overnight futures, international markets, and economic news create the context for today’s action.

Check major indices, sector performance, and leading themes to gauge overall market sentiment before diving into individual stocks.

Scan Pre-Market Movers

Use the Pre-Market Dashboard to identify stocks with significant gaps and volume before the open. Focus on stocks gapping up at least 2% with volume exceeding their 20-day average.

These represent the market’s strongest conviction plays, often driven by earnings beats, analyst upgrades, or breaking news.

Key metrics to monitor include pre-market high, pre-market volume versus average, and percentage change from the previous close. Stocks showing sustained buying pressure in pre-market often continue their momentum into regular hours, especially when breaking out from proper base patterns.

Review Sector and Theme Strength

Nearly 50% of a stock’s price movement comes from its industry group and sector. Use Deepvue’s Theme Tracker to identify which market themes are gaining or losing momentum across daily, weekly, and monthly timeframes. This top-down approach ensures you’re focusing on stocks with group strength at their back rather than fighting against sector weakness.

Create a custom dashboard that displays sector performance, ETF rankings, and industry group relative strength. When you identify a leading theme like AI infrastructure or renewable energy, drill down into the strongest individual stocks within those groups.

Run Your Morning Screeners

Execute your core stock trading routine screeners to surface new opportunities. Start with the fundamentals using Screener Presets like CANSLIM, Deepvue Leaders, or Mark Minervini’s Trend Template. These battle-tested strategies identify stocks with explosive earnings growth, strong relative strength, and institutional backing.

For more nuanced searches, leverage Deepvue’s All/Any logic to build flexible screens. Set baseline requirements for liquidity and trend in your “All” group, then use “Any” groups to cast a wider net for breakout patterns, earnings acceleration, or volume spikes. This approach surfaces quality names you’d miss with rigid filters.

Build Your Focus Watchlist Morning Screeners

Narrow your universe from hundreds of possibilities to 10-20 high-conviction names. Add stocks that meet your criteria to a Focus watchlist, organizing them by setup type using Color Lists. This visual organization helps you quickly identify which stocks are approaching entries versus which need more time to consolidate.

For each stock on your watchlist, identify the specific entry trigger, stop loss level, and position size before the market opens. This preparation removes emotion when opportunity strikes during market hours. Use Mini Charts to analyze multiple timeframes simultaneously, ensuring daily setups align with weekly and monthly trends.

Pre-Market Success Metric: You should finish pre-market prep with a clear watchlist of 10-20 stocks, each with defined entry points and risk parameters. If you’re still searching when the bell rings, you’ve started too late.

The Opening Hour: Where Fortunes Are Made

The first hour of trading provides the most volatility and opportunity of the day. This is when overnight sentiment meets reality, institutional orders hit the tape, and technical patterns either confirm or fail.

Your stock trading routine during this period should focus on tracking your watchlist while monitoring broader market health.

Tracking Stocks from the Open

Monitor Your Watchlist with Real-Time Data.

Use the Stocks from the Open dashboard to track how your watchlist stocks are performing relative to their opening prices. Create bubble charts plotting percentage change from open against volume run rate to visually identify which names are attracting the strongest buying interest.

Stocks that gap up and continue higher from the open with increasing volume demonstrate genuine institutional buying. Conversely, stocks that gap up but immediately reverse show weak holders distributing into strength. The Daily Closing Range (DCR) metric helps distinguish accumulation from distribution throughout the session.

Track Volume Run Rate for Added Conviction.

Volume run rate projects today’s total volume based on current activity. For breakouts to succeed, you want volume at least 50% above the stock’s average daily volume. High run rate in the first 30 minutes typically indicates institutional participation rather than retail enthusiasm that fades by lunch.

Use performance charts and scatter plots to compare volume run rate across your entire watchlist. Stocks combining strong price action with heavy volume warrant immediate attention. Those moving on light volume likely lack conviction and may reverse quickly.

Recognizing Technical Patterns in Real Time

The opening hour reveals how your overnight analysis translates to live action. Use candlestick pattern recognition to identify bullish signals like hammers, engulfing patterns, or pocket pivots forming in real-time. Deepvue automatically labels these patterns on your charts, eliminating guesswork.

Critical Opening Hour Patterns:

- Bullish engulfing candles showing buyers overwhelming sellers from the open

- Pocket pivots with volume exceeding all down days from the previous 10 sessions

- Oops reversals where stocks gap down but close above the prior day’s close

- Stocks holding above key moving averages despite initial selling pressure

Don’t chase extended moves in the first 15 minutes. Wait for stocks to establish a range, then enter on pullbacks to support or breakouts above resistance with volume confirmation. The best entries often come 30-60 minutes after the open when early volatility subsides but momentum persists.

Mid-Day Market Hours: Discipline Over Action

After the opening hour flurry, successful traders shift to monitoring mode. The mid-day period typically sees lower volume and choppier action.

Your stock trading routine should focus on managing existing positions, tracking watchlist stocks approaching entries, and preparing for the late-day push.

Track Relative Strength Throughout the Day

The strongest stocks separate themselves during mid-day consolidation. Use RS Day screening to identify stocks holding gains or even rising while the broader market weakens. These names demonstrate institutional support and often lead when the market rebounds.

Add columns for percentage change, DCR, and RS rating to your watchlist to quickly spot divergences. Stocks up 2%+ on a day when indices are down 1% show exceptional strength. These are tomorrow’s leaders accumulating in plain sight.

Use Multi-Timeframe Analysis

Don’t get lost in intraday noise. Regularly check your multi-timeframe layouts to ensure intraday moves align with daily, weekly, and monthly trends. A 5-minute pullback that appears concerning may simply be a normal retracement on the hourly chart.

Set up custom chart layouts displaying 5-minute, 15-minute, daily, and weekly timeframes simultaneously. This perspective prevents you from taking premature profits on normal consolidation or adding to positions that are breaking down on higher timeframes.

Screen for New Breakout Opportunities

Don’t limit yourself to pre-market ideas. Run breakout screeners during the day to catch stocks making new 52-week highs or Green Line Breakouts to all-time highs. The Highest Volume Edge screener identifies stocks experiencing unusual institutional buying that warrants immediate attention.

These intraday screeners often surface stocks you overlooked during pre-market prep. When a stock breaks out mid-day with proper volume and a high closing range, it can provide excellent entry opportunities for the next leg higher.

Managing Risk and Position Sizing

The mid-day session is when poor positions reveal themselves. If a stock breaks below your predetermined stop loss, exit immediately without hesitation. Successful trading requires cutting losses quickly and letting winners run.

Use alerts to monitor key technical levels rather than watching screens constantly. Set conditional alerts for breakouts above resistance with volume confirmation or breaks below support that trigger stop losses. This systematic approach removes emotion from exit decisions.

Mid-Day Discipline: The best trades often require patience. Don’t force action during choppy mid-day conditions. Wait for clear setups that meet your predefined criteria rather than trading out of boredom.

The Final Hour: Where the Day Is Won or Lost

The last hour of trading frequently sees increased volume as institutional traders adjust positions before the close. This period provides a final opportunity to enter strong setups or exit weak positions.

Your stock trading routine during this window should focus on how stocks finish relative to their intraday ranges.

Evaluating Closing Action

Closing Strength – Daily Closing Range Analysis:

Stocks closing in the upper third of their daily range (DCR above 67%) demonstrate buying pressure and often continue higher the next day. Conversely, stocks closing near their lows regardless of intraday gains show distribution and weak holders.

Volume Profile – Late-Day Volume Surge:

Increasing volume at the close signals conviction. Institutions often place orders in the final 30 minutes, creating late-day momentum. Stocks combining strong closes with volume surges deserve close monitoring for tomorrow’s continuation.

End-of-Day Checklist:

- Check DCR on all watchlist stocks – mark those closing above 70% for review

- Note which stocks finished on increased volume versus lighter volume

- Identify sector winners and losers to understand money flow

- Update stop losses on positions to protect profits or limit risk

Review your open positions to assess whether they’re acting correctly. Stocks you bought for breakouts should be holding their gains and closing strong.

Stocks failing to follow through may warrant stops even if they haven’t hit your predetermined exit level. Trusting price action at the close is one of the most important aspects of a successful stock trading routine.

After-Hours Analysis: Learning and Preparation

The real growth in your trading skill happens during after-hours review. This is when you analyze what worked, what didn’t, and build tomorrow’s game plan without the pressure of live markets.

Dedicate 30-60 minutes each evening to structured review as a core component of your stock trading routine.

Journal Your Stock Trades

Document every trade with entry reason, exit reason, and lessons learned. Note whether you followed your plan or made emotional decisions. Over time, patterns emerge showing your strengths and weaknesses. The best traders constantly refine their approach based on objective review.

Analyze Market Leaders

Study the day’s strongest performers regardless of whether you traded them. What sectors led? Which stocks made new highs on volume? Understanding market leadership helps you position yourself in front of trends rather than chasing them late.

Use the After-Hours Dashboard to review post-market movers and earnings reports. Stocks gapping significantly after hours often continue their momentum the next day, providing early entries before the crowd arrives.

Build Tomorrow’s Watchlist

Update your watchlists based on today’s action. Remove stocks that failed setups or show distribution. Add new names from your evening screeners that are setting up for potential entries. This preparation ensures you’re ready when the pre-market opens tomorrow.

Run screens for stocks forming tight consolidations, testing key moving averages, or showing three-week tight patterns. These setups often trigger within days, providing advance notice of high-probability trades.

Check Economic and Earnings Calendars

Review tomorrow’s economic events, earnings reports, and potential catalysts. Federal Reserve announcements, jobs data, and major company earnings can create volatility that either presents an opportunity or requires defensive positioning. Plan accordingly.

Key Takeaways: Your Daily Stock Trading Routine

- Start your stock trading routine during the pre-market by scanning overnight movers, reviewing sector strength, and running core screeners to build your daily watchlist of 10-20 high-conviction names.

- Monitor the opening hour intensely using real-time volume run rate and DCR to identify which stocks are attracting genuine institutional buying versus retail enthusiasm.

- During mid-day hours, track relative strength to find stocks holding gains despite market weakness. These are tomorrow’s leaders, accumulating institutional support.

- Use multi-timeframe analysis throughout the day to ensure intraday moves align with daily and weekly trends, preventing you from overreacting to normal volatility.

- Evaluate closing action by analyzing DCR and late-day volume – stocks finishing strong on heavy volume often continue their momentum the next session.

- Conduct after-hours review by journaling trades, studying market leaders, and building tomorrow’s watchlist without the pressure of live markets.

- Leverage Deepvue’s All/Any screening logic to build flexible searches that surface quality setups without forcing stocks to meet overly rigid criteria.

- Focus on stocks with group strength using Theme Tracker. Remember: More than half of the price movement comes from sector and industry performance.

Building an effective stock trading routine is about consistency. Remember that market conditions change, but principles remain constant.

Strong stocks break out of proper bases on volume. Leaders show relative strength during corrections. Institutions leave footprints through volume and closing ranges.

Your stock trading routine should be flexible enough to adapt to changing conditions while rigid enough to maintain discipline when emotions run high.