Last Updated:

July 25, 2025

Who is Kristjan Kullamägi (Qullamaggie)

Kristjan Kullamägi, better known as Qullamaggie, is a self-made multimillionaire trader from Stockholm, Sweden, who has grabbed the attention of traders around the globe with his incredible rise, disciplined strategy, and refreshingly simple approach. Qullamaggie turned a modest $5,000 into more than $100 million in under a decade.

And instead of selling courses or mentorships, he shares his knowledge for free on platforms like Twitch, YouTube, and X.

Like many beginners, he struggled early on, beginning trading in 2011, blowing up several accounts while chasing alerts and lacking a solid strategy. By 2013, he had his first profitable year.

By 2017, he was financially independent. And by 2020, he had turned that original $5,000 into over $100 million in trading profits.

His journey shows what’s possible when you combine hard work, pattern recognition, and discipline. For anyone serious about trading, Qullamaggie is more than just a success story – his story is a blueprint for you to understand how to become successful in the markets.

What kind of trader is Qullamaggie?

Qullamaggie started as a day trader, making his first million on intraday moves. But over time, he found his sweet spot in swing trading, where trades last a few days to a few weeks. It’s less stressful, and the potential gains are bigger.

He focuses on momentum breakouts, aiming to catch big moves when a stock is ready to run. His three go-to setups are:

- High tight flags (HTFs)

- Continuation patterns like triangles and volatility contractions

- Episodic pivots (EPs) breakouts after strong news or earnings gaps

He mostly uses daily charts, but zooms into hourly or 5-minute charts to fine-tune his entries, especially right after the market opens.

What types of stocks does Qullamaggie trade?

Qullamaggie looks for high-momentum stocks with strong relative strength – the ones that keep going up even when the rest of the market is struggling.

He screens for stocks in the top 1–2% of performers over the past 1 to 6 months. Many of these show 30–100%+ moves in short windows. They’re usually part of hot sectors like tech or biotech and are driven by news or earnings.

Qullamaggie avoids random penny stocks or companies with no real catalyst. Instead, he sticks with NASDAQ-listed leaders that show consistent strength.

For example, during the AI boom, he focused on AI-driven tech names because they offered the highest-probability setups. His favorite patterns often form after a big run-up, then a tight pause, before making another leg higher.

How stocks continue their trend

Swing trading is really just about following the trend. Most stocks in an uptrend won’t go up in a straight line – they’ll often pause and move sideways before taking another leg higher.

That’s exactly what Qullamaggie looks for. His edge comes from spotting stocks that have already had a big run in recent months.

Then, when volume starts to fade and the stock consolidates, he looks for signs that it’s holding up better than the overall market.

How to screen for a continuation base

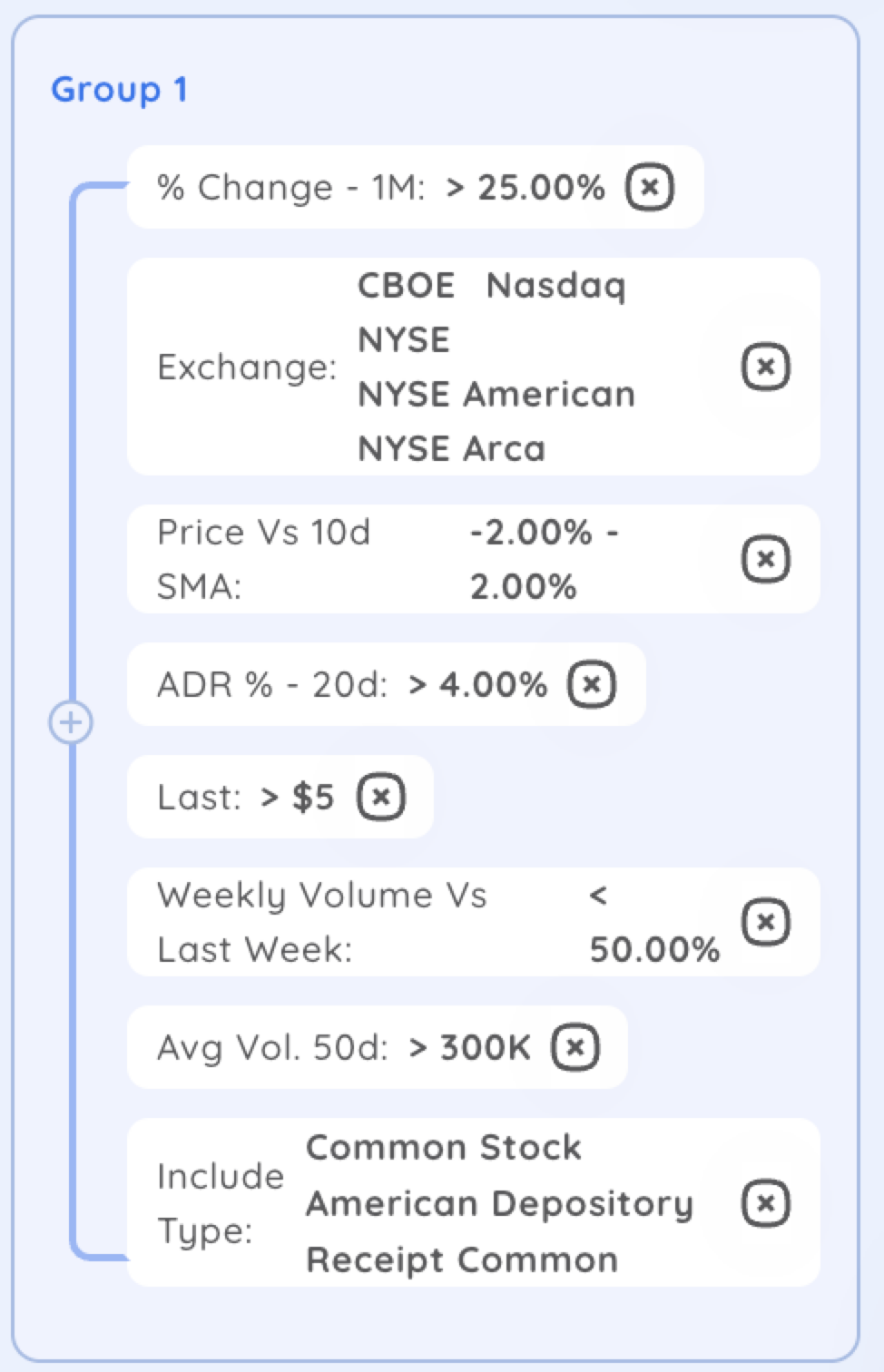

Start with stocks that are already showing strength, up at least 25% in the past month.

Next, check multiple timeframes and pay close attention to weekly volume. You’re looking for signs of consolidation. A good clue? The current week’s volume is at least 50% lower than the week before.

Finally, make sure the stock is trading close to its 10-day simple moving average (SMA), within about 2% above or below.

How episodic pivots reveal strength

Episodic Pivots (EPs) show up when a stock reacts to a major catalyst with a sharp price move and strong volume. This is a big deal. It means investors are revaluing the stock in real time based on fresh, powerful news.

When a stock gaps up on good news and holds those gains? That’s a sign of strong demand and likely the beginning of a new momentum-driven trend.

How to screen for an episodic pivot

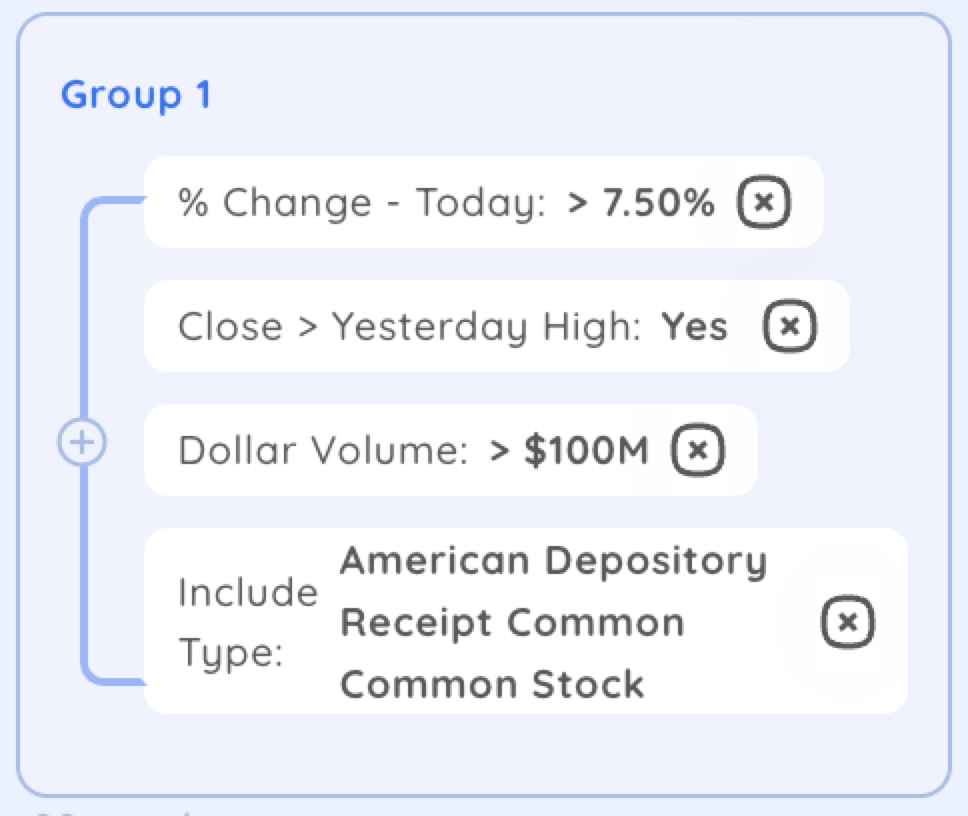

An EP is simple to spot: look for a one-day move of over 7.5%.

But here’s the key: Qullamaggie focuses on names with dollar volume over $100 million. That filters out the smaller, less-liquid plays and helps you zero in on stocks that institutions are trading.

Why top monthly gainers see more strength

When big money is buying, they can’t take full positions in one day. They accumulate shares slowly, sometimes over weeks or even months.

That’s why stocks that are already up big over the past month often keep going. That kind of strength usually isn’t a fluke – it’s a sign of serious buying behind the scenes.

How to screen for top gainers

To spot these setups, Deepvue uses the Absolute Strength (AS) Rating. This tool focuses purely on price momentum, no fundamentals or relative strength, just pure movement. The higher the rating, the stronger the stock.

Qullamaggie also checks the Average Daily Range (ADR). A high ADR means the stock moves a lot during the day, which is great for swing trading.

So when screening, look for stocks with both a high AS Rating and a strong ADR.

Using Qullamaggie screener presets in Deepvue

To make finding stocks easy, Deepvue partnered with Kristjan Kullamägi, and other top traders, to help you find stocks like the pros.

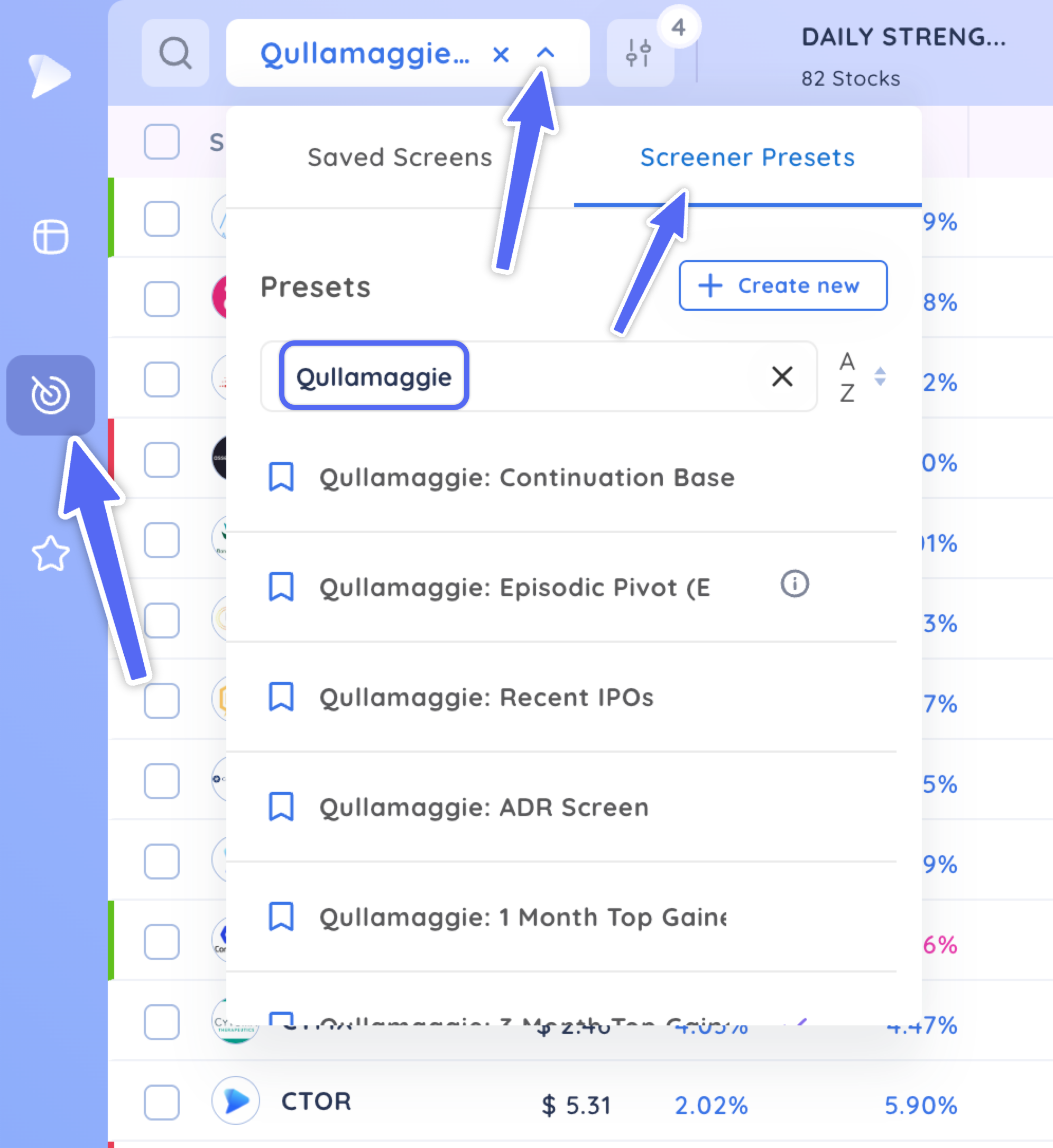

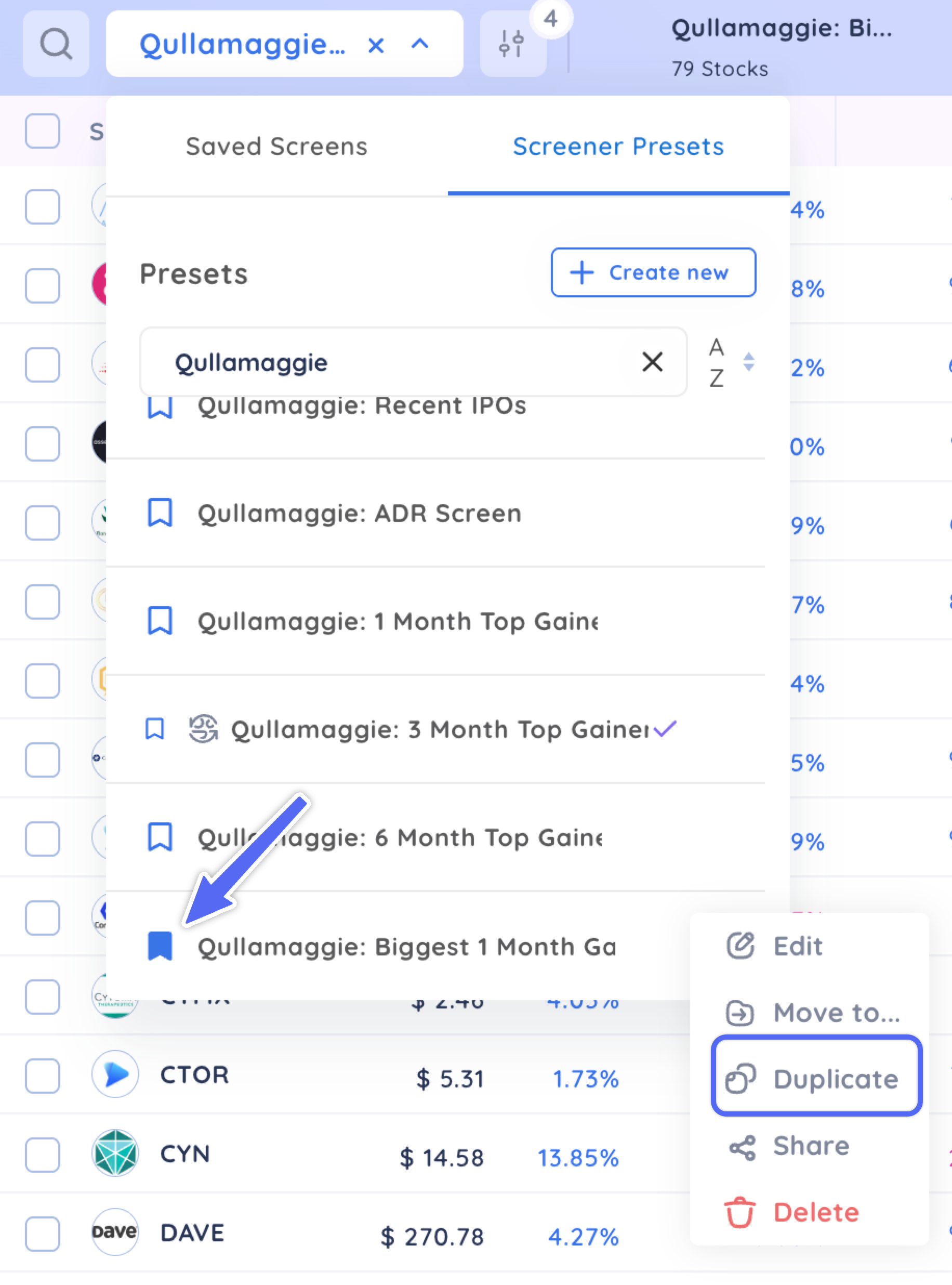

In the Screener module, navigate to the Screener Preset tab and type Qullamaggie. You will see all the available screens Qullamaggie uses to find high-momentum stocks.

Bookmark any screen to pin it to the top of your screener module by clicking the bookmark icon. Click the three dots to duplicate any screen into your saved screens to make it your own.

Key takeaways from Qullamaggie’s strategy

Kristjan Kullamägi, aka Qullamaggie, isn’t just a success story, he’s living proof that with the right mindset, process, and discipline, you can scale from small beginnings to massive results.

Here are the biggest takeaways from his trading strategy:

- Stick with strength – Focus on stocks already showing big gains. Momentum tends to continue when institutions are behind the move.

- Look for clean consolidations – Before a stock makes its next leg up, it usually tightens up and volume drops. That’s your cue to prepare.

- Use episodic pivots – Huge one-day moves on high volume, often driven by news, can mark the start of powerful trends.

- Go where the action is – Qullamaggie trades liquid, NASDAQ-listed leaders, not random penny stocks.

- Screen with purpose – Use tools like Deepvue’s AS Rating, ADR, and Qullamaggie’s own presets to consistently find high-probability setups.

- Keep it simple – You don’t need fancy indicators or thousands of trades. Master a few patterns and trade them with discipline.

If you’re serious about growing as a trader, Qullamaggie’s playbook offers a focused, proven framework. It’s not easy, but it’s simple, and that’s the beauty of it.