Last Updated:

December 6, 2025

Why Volume Analysis Matters for Swing Traders

Volume analysis is the hidden language of the stock market. While most traders fixate on price action alone, seasoned professionals know that volume reveals what institutions are doing behind the scenes.

Technical analysis rests on two fundamental pillars: price and volume. While price tells you where a stock has been, volume reveals the conviction behind every move.

Think of volume as the fuel powering price action. Without it, even the most promising breakouts tend to fizzle out.

For swing traders and position traders, volume analysis provides critical insight into whether institutional investors are accumulating shares or quietly distributing them to retail traders. Since institutions cannot hide their activity due to the sheer size of their orders, their footprints appear as distinctive volume patterns that trained eyes can identify.

What Volume Analysis Reveals:

- Whether institutional investors are buying or selling

- The strength and sustainability of price trends

- Potential reversal points before they happen

- Confirmation of breakouts from key technical patterns

- Warning signs of distribution disguised as healthy consolidation

Understanding how volume interacts with price transforms your ability to read charts. Instead of guessing whether a move will continue, you can assess the institutional commitment behind it.

7 Essential Volume Signals Every Trader Must Know

Volume analysis becomes powerful when you recognize specific patterns that repeat across market cycles. These seven signals form the foundation of professional volume interpretation and can dramatically improve your trade selection.

Volume Confirmation on Breakouts

When a stock breaks above resistance or out of a base pattern, volume should surge at least 50% above the 50-day average. This volume spike confirms that institutional buyers are driving the move, not just retail speculation.

Breakouts on light volume frequently fail because they lack the buying power needed to sustain higher prices. Before entering any breakout trade, verify that volume supports the move.

Volume Dry-Up During Consolidation

One of the most bullish signals occurs when volume contracts significantly during a base or pullback. This dry-up indicates that selling pressure has exhausted itself. Weak holders have already exited, and remaining shareholders are committed to their positions.

When institutions accumulate shares methodically, they do so without pushing prices higher, resulting in tight price action on declining volume. Identifying this quiet accumulation pattern often precedes explosive breakout moves.

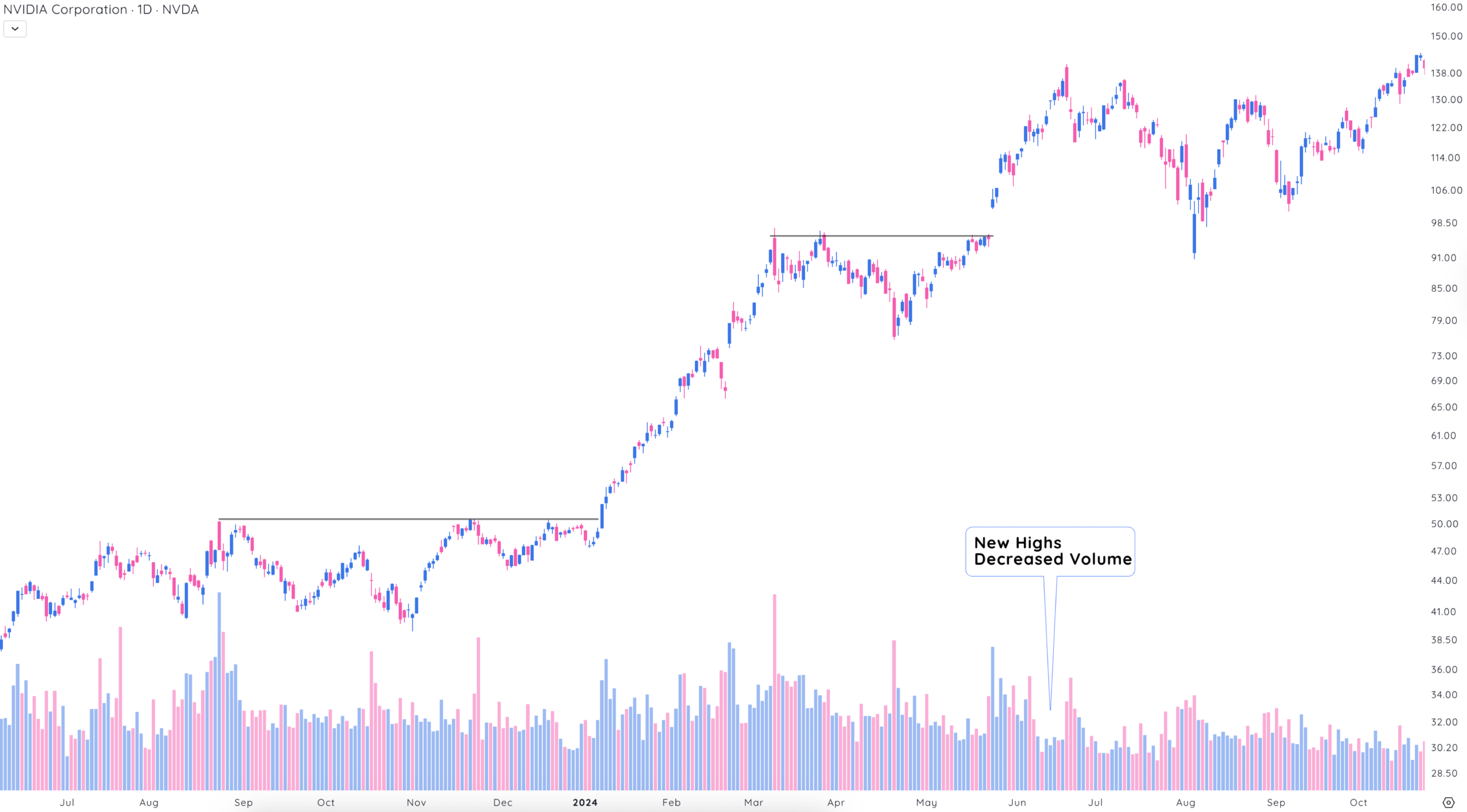

Volume Divergence Warning

When price makes new highs, but volume decreases, exercise caution. This negative divergence suggests weakening buying conviction and often precedes trend reversals.

The smart money may be quietly selling into strength while retail traders chase the rally. Conversely, when price makes lower lows on diminishing volume, the downtrend may be losing steam as sellers exhaust themselves.

Pocket Pivots: Enhanced Volume Days

Not all high-volume days carry equal significance. The strongest breakouts happen when above-average volume is combined with strong price action throughout the base, specifically when a candle closes in the upper portion of its daily range.

A pocket pivot occurs when the current up day’s volume is larger than any of the down volume days in the prior 10 days. This combination signals genuine institutional buying pressure rather than churning or distribution. Using enhanced volume indicators helps filter out noise and focus on days that truly matter.

Relative Volume Spikes

During healthy base formations, observe the volume pattern carefully. Ideal bases show declining volume as the pattern develops, with occasional bursts of buying volume on up days. These volume surges within the base indicate institutional support and accumulation.

If you see consistently high volume without price progress (churning), institutions may be distributing shares rather than accumulating them. The Volatility Contraction Pattern (VCP) specifically looks for this volume signature before breakouts.

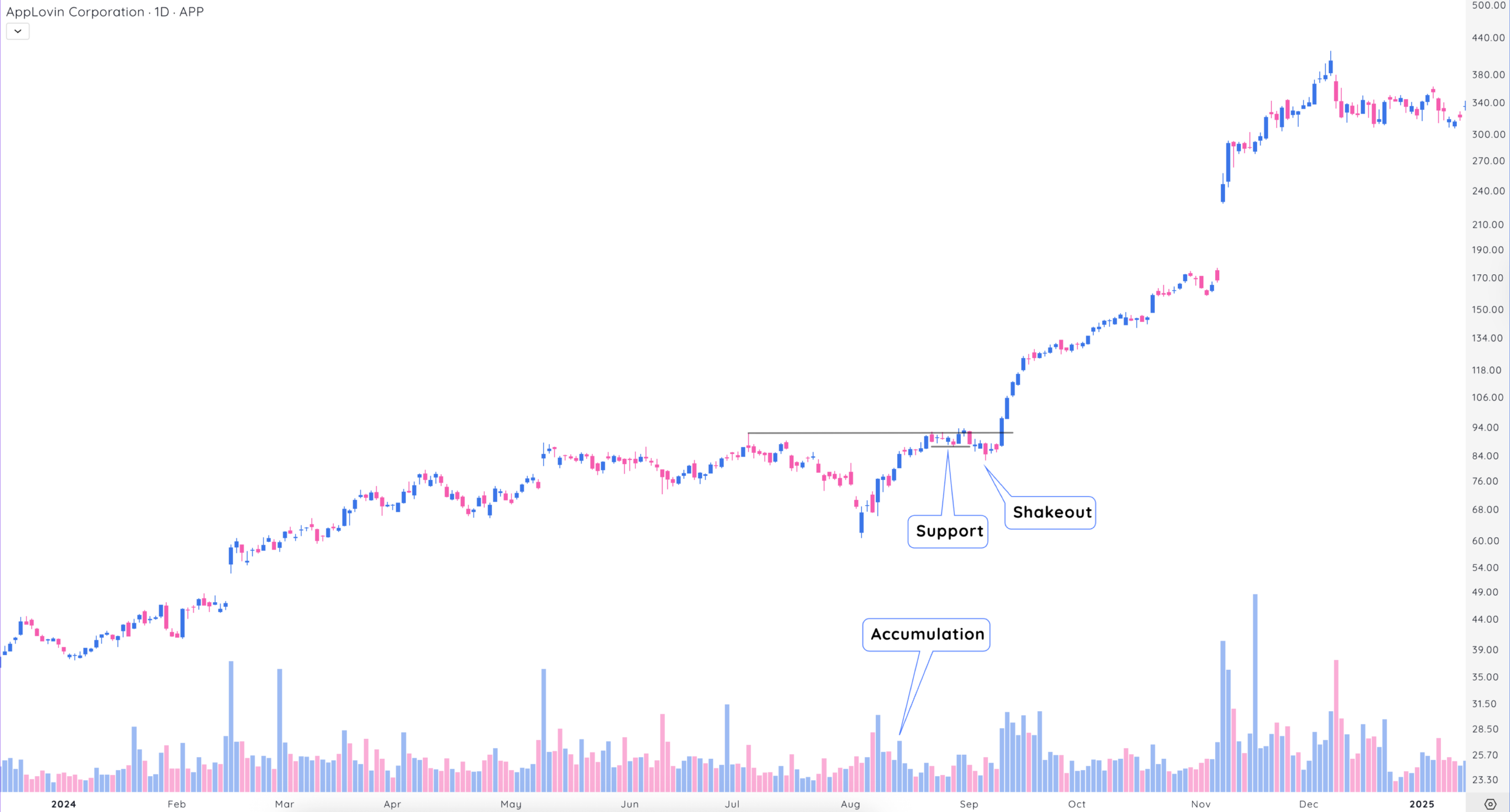

Shakeout Volume Signature

Shakeouts occur when price temporarily undercuts a support level or base low, triggering stop losses, before reversing higher and closing strong. The volume signature of a successful shakeout shows heavy volume on the undercut, followed by a recovery close above the support level.

This action indicates that institutions absorbed shares from panicked sellers – an extremely bullish signal. Recognizing shakeout patterns in flat bases can provide excellent entry opportunities with defined risk.

Spotting Institutional Accumulation vs. Distribution

The ability to distinguish between accumulation and distribution separates profitable traders from the crowd. Institutions cannot hide their activity, as their massive orders leave footprints in the volume data that reveal their intentions.

Bullish Signals – Signs of Accumulation:

Accumulation occurs when institutions quietly build positions without alerting the broader market.

- Tight price ranges with declining volume

- Higher volume on up days than down days

- Price holds support despite selling attempts

- Shakeouts that recover quickly

Bearish Signals – Signs of Distribution:

Distribution happens when institutions sell shares into buying pressure, often disguising their activity.

- High volume without corresponding price gains (churning)

- Heavy volume on down days

- Price fails to make new highs despite bullish sentiment

- Wide and loose price action

Fund managers who accumulate massive positions buy methodically within specific price ranges to avoid pushing prices higher. This creates the characteristic tight, quiet price action on low volume that precedes major advances.

When you spot accumulation volume patterns in leading stocks with strong fundamentals, you’ve identified a potential winner before the crowd notices.

Climax Volume Patterns: Spotting Exhaustion and Reversal Points

Climax volume events mark critical turning points in trends. These extreme volume spikes signal exhaustion, either of buying pressure at tops or selling pressure at bottoms. Learning to identify climax patterns can help you avoid buying at peaks and recognize capitulation lows.

Bullish Trend Exhaustion – Climactic Blow-Off Top:

A climax top occurs near the end of an extended uptrend when the price accelerates vertically on massive volume. This parabolic move, accompanied by the highest volume in months, often marks the final euphoric surge before reversal.

The extreme volume represents the last buyers rushing in at precisely the wrong moment. After the climax, demand exhausts itself, and prices typically reverse sharply. Stan Weinstein’s classic work on stage analysis and Oliver Kell’s Cycle of Price Action extensively cover these topping patterns.

Bearish Trend Reversal – Capitulation Low:

Capitulation marks bottoms where fearful investors dump shares at any price. You’ll see price plunge sharply on the highest volume in weeks or months, often with wide-range down days.

However, the key signal comes when the price stabilizes or reverses despite the extreme selling pressure. This volume exhaustion indicates that weak holders have finally capitulated, clearing the way for recovery. Combining this signal with relative strength screens during corrections helps identify which stocks will lead the next rally.

Key Takeaways: Start Reading Volume Like a Professional

Volume analysis transforms chart reading from guesswork into informed decision-making. By understanding the seven signals outlined above, you gain insight into what institutions are doing before the crowd catches on.

- Volume reveals institutional activity that price alone cannot show. Learn to read these footprints to trade alongside smart money.

- Breakouts require volume confirmation of 50%+ above average to validate institutional buying and increase success probability.

- Volume dry-up during consolidation signals exhausted selling pressure and often precedes powerful breakout moves.

- Volume divergence warns of trend weakness. Be cautious when the price makes new highs on declining volume.

- Accumulation shows tight price action on low volume with occasional buying surges; distribution shows churning with high volume but no price progress.

- Climax volume events mark potential reversal points. Extreme volume after extended moves signals exhaustion.

Over time, pattern recognition becomes intuitive, and you’ll spot accumulation and distribution signatures that others miss entirely.

Remember: price shows you what happened, but volume tells you why it matters. Master this distinction, and you’ll make better trading decisions with greater confidence.