Last Updated:

November 12, 2025

Why Individual Investors Should Track Smart Money

The simple answer is that large institutions move the markets.

When institutions begin accumulating positions, they deploy millions or billions of dollars, creating sustained demand that drives prices higher over weeks and months. So if you can track smart money, you’ll gain insights that could seriously improve your trading.

Institutions employ teams of analysts who conduct extensive due diligence before making investment decisions. These professionals have access to company management through earnings calls and investor meetings, analyze industry dynamics comprehensively, and evaluate competitive positioning with sophisticated financial models.

When institutions commit capital, they have conviction based on thorough fundamental analysis.

Stocks with strong institutional backing demonstrate better liquidity characteristics than those dominated by retail traders. When multiple institutions own a stock, trading becomes smoother with tighter bid-ask spreads and reduced volatility.

That kind of liquidity means you can enter or exit trades without dealing with wild price swings. It’s another reason why learning to track smart money gives you an edge, because they go where the conditions are right.

What Are Institutional Investors?

Institutional investors, also known as smart money, represent the largest pool of capital in financial markets, managing over seventy trillion dollars globally. These are not individual traders making decisions from home offices, but rather large organizations investing on behalf of millions of people and controlling enough capital to significantly influence stock prices through their buying and selling activity.

Their buying and selling power can move markets, and that’s why you want to track smart money whenever you can.

Major Categories of Institutional Investors:

- Pension Funds & Endowments: Manage retirement assets for employees and retirees, representing approximately thirty-five trillion dollars globally. University endowments and foundations manage assets to support educational institutions, hospitals, and charitable organizations. These investors typically have long time horizons, seeking stable growth with manageable risk profiles.

- Mutual Funds & ETFs: Pool capital from individual investors to invest in diversified portfolios. Exchange-traded funds provide similar diversification with greater trading flexibility. These vehicles have democratized access to professional management, with millions of American families participating in capital markets through retirement accounts and brokerage holdings.

- Hedge Funds: Employ diverse strategies, including long-short equity, arbitrage, and quantitative approaches. While representing a smaller portion of institutional capital, hedge funds often take concentrated positions and can move quickly compared to larger, more conservative institutions. Their activity frequently signals emerging opportunities.

- Insurance Companies & Banks: Insurance companies invest premiums to meet future policyholder claims, while banks manage investment portfolios alongside their lending operations. These institutions prioritize capital preservation and income generation, though they also participate in growth opportunities when fundamentals align with their risk parameters.

How Institutional Buying Drives Price Movement

Institutions cannot simply buy large positions at current market prices without driving prices higher. A fund manager needing to acquire five hundred thousand shares must accumulate methodically over weeks or months, buying carefully to keep average costs low while managing risk.

This process creates distinctive patterns visible through volume and price analysis.

During accumulation phases, institutions provide buying support that prevents significant declines. As multiple institutions recognize the same opportunity, their combined demand eventually overwhelms available supply, triggering breakouts to new highs.

This is precisely why William O’Neil emphasized that the biggest winners often emerge from stocks making new highs rather than trading near their lows.

Track Smart Money: What Institutions Look For

If you want to track smart money effectively, you’ve got to understand how they pick stocks. While different institutions have varying strategies, certain fundamental characteristics consistently appear in institutional portfolios.

Earnings Growth and Quality:

Institutions prioritize companies demonstrating strong, consistent earnings growth. The baseline expectation is annual earnings per share growth of twenty-five percent or higher over the past three years, with acceleration in recent quarters signaling increasing business momentum.

Quarterly earnings reports must show year-over-year growth of at least twenty-five percent, though many institutional investors seek even higher rates. Triple-digit earnings growth particularly attracts attention, as it suggests a company experiencing rapid market share gains or benefiting from a powerful secular trend. Earnings acceleration, where growth rates themselves increase quarter over quarter, provides the strongest signal of sustainable momentum.

Revenue Growth and Market Share:

While earnings growth captures headlines, institutions scrutinize revenue growth to validate business expansion. Strong sales growth of fifteen to twenty percent annually demonstrates genuine market demand for products or services. Institutions become particularly interested when revenue growth accompanies margin expansion, indicating both top-line momentum and operational efficiency improvements.

Market leadership matters tremendously. Institutions prefer companies that are number one or two in their industry, as these positions typically confer competitive advantages. Leading companies capture disproportionate value creation during industry growth phases and demonstrate greater resilience during downturns.

Liquidity and Market Capitalization:

Liquidity represents a critical consideration for institutional investors deploying large capital amounts. Stocks must have sufficient average daily trading volume to allow position building and exit without significant market impact. Volume in the millions of shares daily provides optimal conditions for institutional participation.

Market capitalization requirements vary by institution size. Smaller hedge funds and boutique investment firms can invest in companies with a market cap under two billion dollars, while larger pension funds and mutual funds require mid-cap to large-cap stocks with market capitalizations exceeding two billion dollars. This dynamic creates interesting opportunities as smaller institutions often identify winners before larger players can participate meaningfully.

Relative Strength and Technical Position:

Institutions increasingly incorporate technical analysis alongside fundamental research. Relative strength ratings help identify market leaders. Stocks with relative strength ratings of eighty-seven or higher demonstrate consistent outperformance and attract institutional attention.

Technical position matters because institutions seek stocks in constructive chart patterns, particularly those near or making new fifty-two week highs. These technical breakouts signal that demand exceeds supply and that other institutions are likely accumulating shares. Stocks breaking out from proper base patterns with volume confirmation provide ideal entry opportunities for institutional capital.

The Institutional Screening Framework

When screening for institutional-quality stocks, prioritize companies that meet multiple criteria simultaneously.

Look for

- Earnings and sales growth exceeding 25% with accelerating quarters

- Relative strength ratings in the top fifteen percent of all stocks

- Sufficient liquidity with an average daily volume over $25M

- Market leadership positions in growing industries

- Technical breakouts from proper base patterns.

By using this kind of institutional framework, you’ll be able to track smart money and align your trades with real market movers.

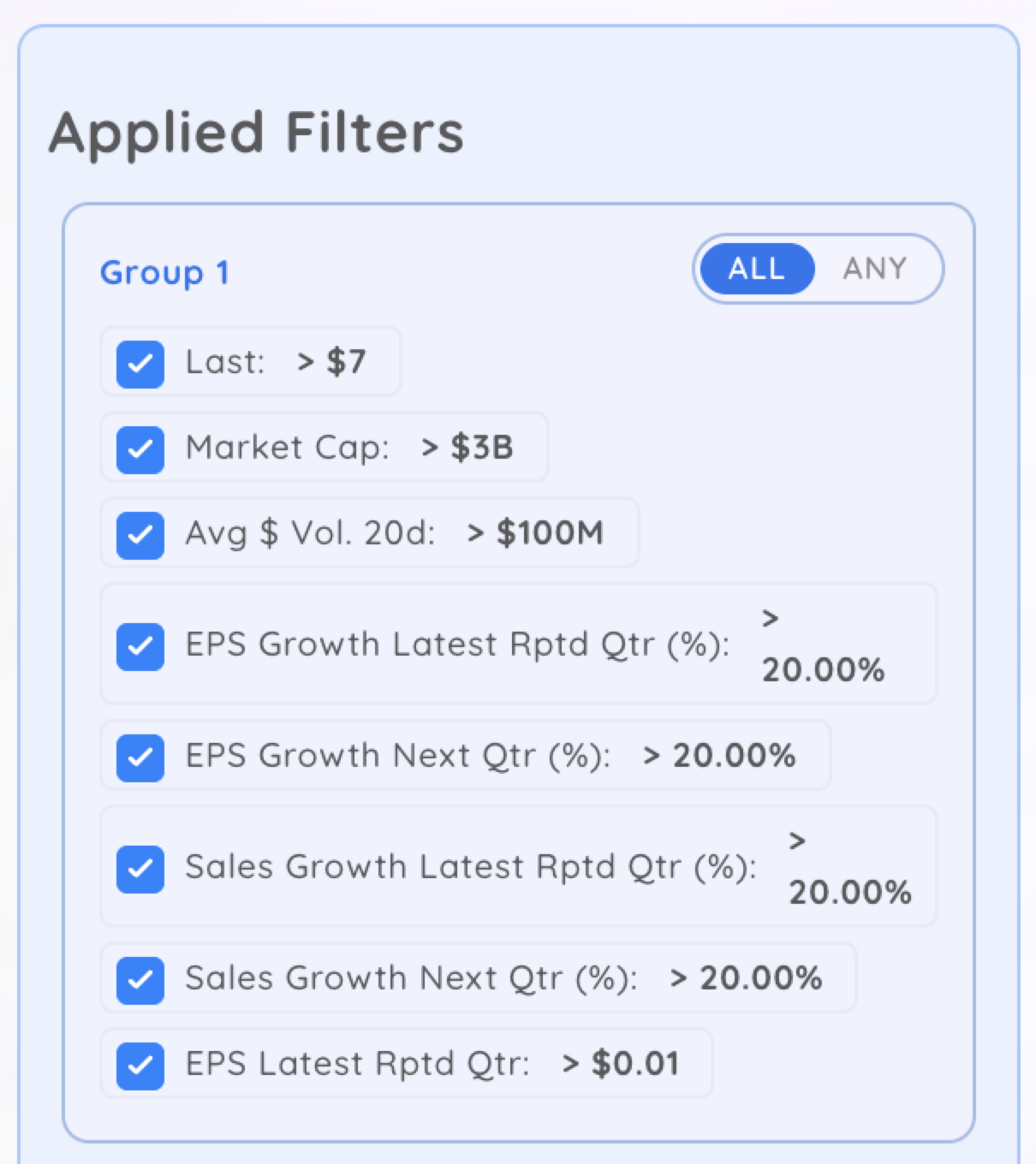

Screen for 20%+ Growth to Track Smart Money

If you want to trade stocks that have real momentum behind them, start by looking for companies posting at least 20% growth in earnings per share (EPS) and sales. This is the kind of fundamental strength that catches the attention of institutional investors, and it’s a proven filter for identifying high-potential setups before the crowd catches on.

When a company shows consistent 20%+ growth in both earnings and revenue, it signals strong demand, expanding margins, and solid execution. To track smart money, what really matters is that both the current and next quarter are projected to hit 20% or more in EPS and sales.

To build a high-conviction list of stocks with strong fundamentals, set your filters to look for:

- EPS growth of 20% or more in the current quarter

- EPS growth of 20% or more in the next quarter

- Sales growth of 20% or more in the current quarter

- Sales growth of 20% or more in the next quarter

Institutions favor companies that are not just growing, but doing so consistently and with scale. The 20% rule helps you identify those leaders early.

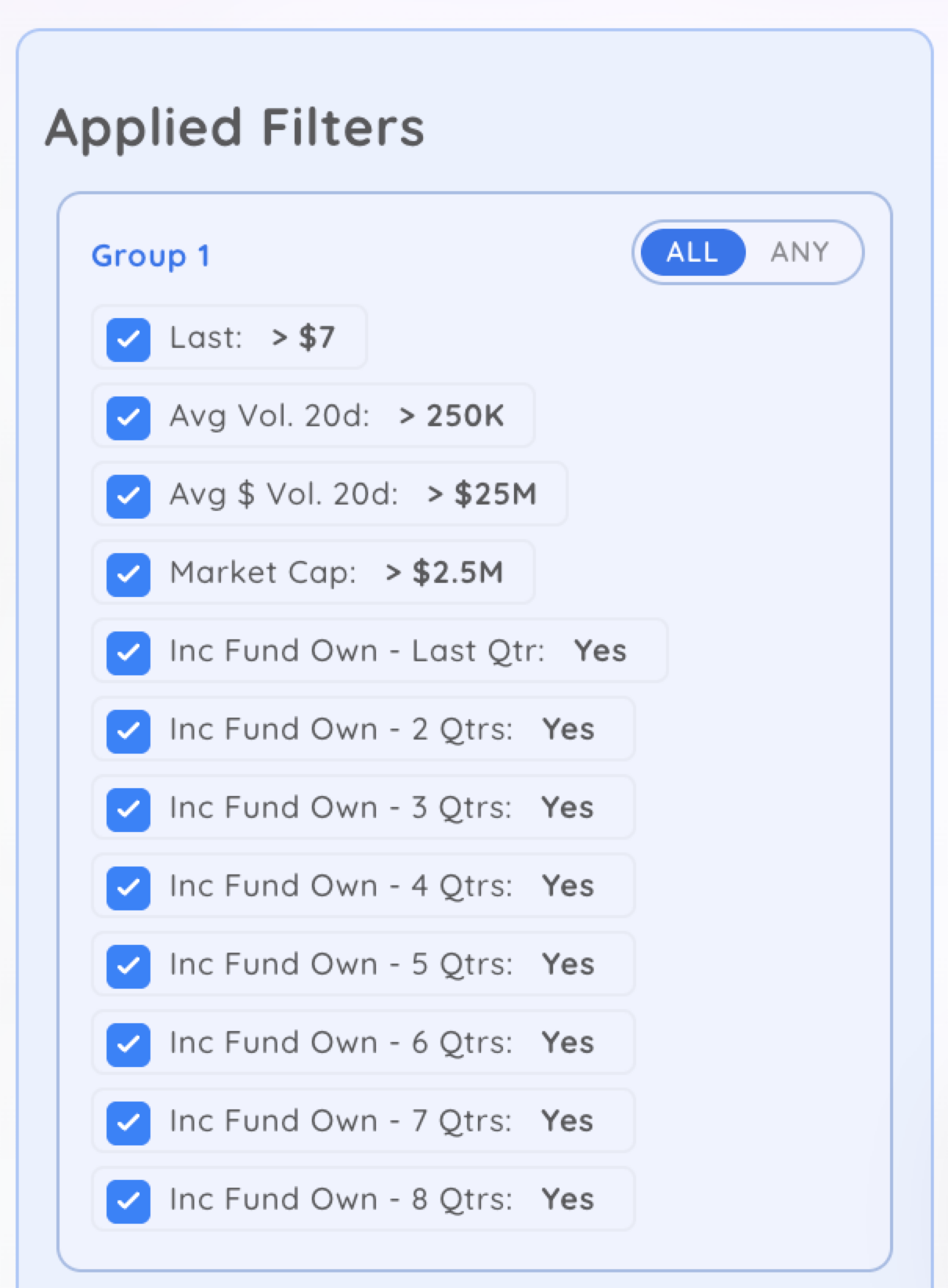

Screen for Rising Institutional Ownership to Trade With the Big Money

Watch where the institutions are going – Pension funds, hedge funds, and mutual funds move markets with billions of dollars. And when they start buying into a stock, it often marks the beginning of a major trend.

Because of how large their positions are, institutions usually take weeks or even months to build a full stake. That slow accumulation often supports the stock and drives steady price increases.

Institutions do deep research before they invest. They’ve got entire teams of analysts, access to company management, and tools retail traders don’t. By screening for rising institutional ownership, you can follow in their footsteps and position yourself early in potential breakout moves.

To stay on top of institutional activity, set your screener to look for stocks with:

- Consistent ownership growth over the past few quarters

- Quarter-over-quarter increases in institutional ownership

- A growing number of institutions holding the stock

- Continued institutional ownership growth in the past two years

Rising institutional ownership brings more than just capital. It brings stability, liquidity, and longer holding periods. If you’re able to track smart money through ownership data, you can spot accumulation early—and ride the trend.

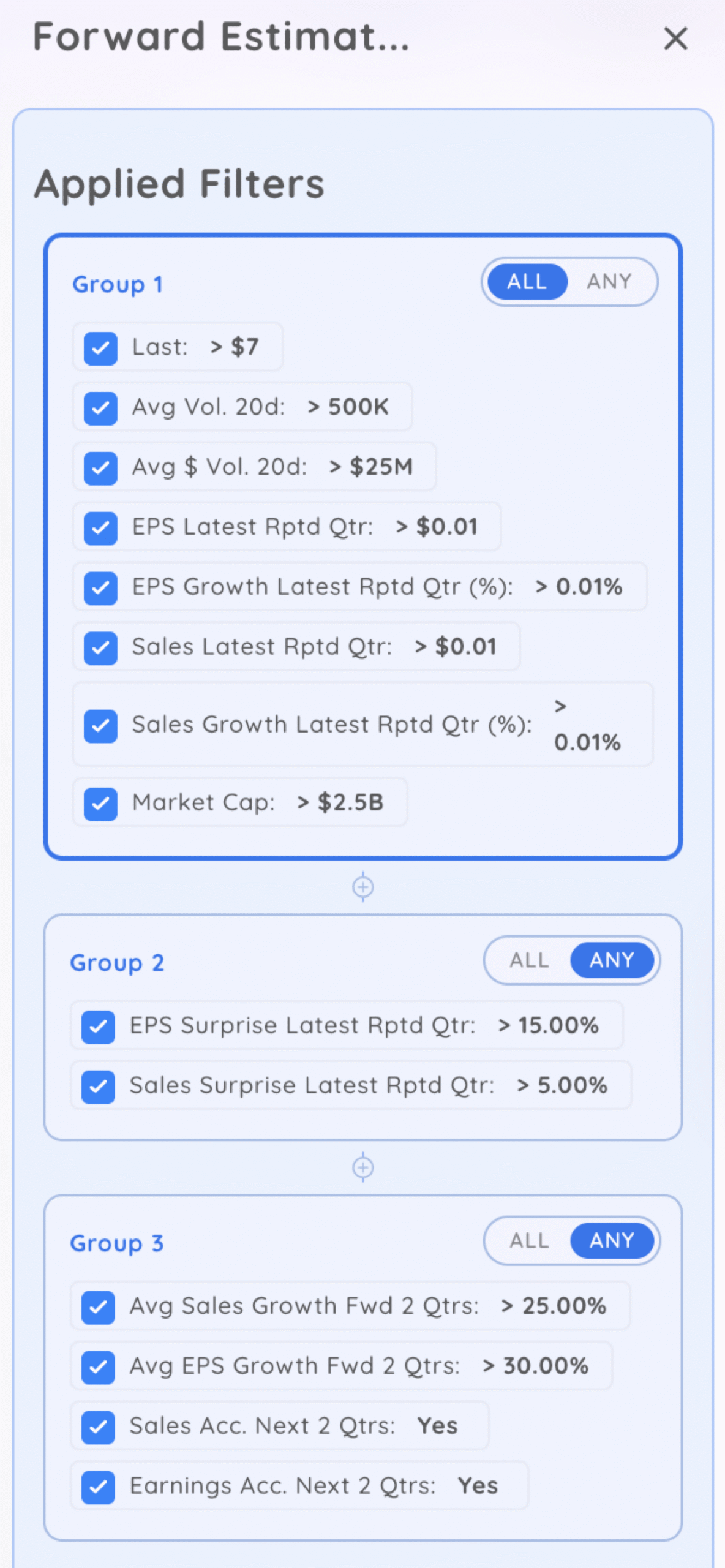

Use Forward Estimates and Revisions to Spot Institutional-grade Stocks

If you’re trying to find the kinds of stocks big institutions love to trade, start by screening for companies with strong forward estimates and positive revisions. These two signals are often early indicators of future stock performance, and they’re exactly what institutional investors track before moving millions into a position.

Forward estimates reflect how analysts expect a company to perform in future quarters and years. When you see projections for strong earnings per share (EPS) and sales growth, especially triple-digit estimates, that’s a major green flag. It means analysts believe the company is expanding rapidly, and that kind of momentum tends to attract serious buying from funds and large investors.

When building or using a screener, focus on:

- Quarter-over-quarter and year-over-year EPS and sales growth

- Forward estimates with projected gains of 25% or more

- Recent upward revisions from analysts after earnings reports

- First-time positive EPS or major jumps after a string of weak quarters

- EPS and sales surprise

To consistently spot these opportunities, you’ve got to track smart money often to find a combination of massive estimate growth and repeated upward revisions.

Final Thoughts: How to Track Smart Money the Right Way

If you want to trade with the trend, not against it, you’ve got to track smart money. Institutions don’t just move the market, they shape it.

By using screeners focused on 20%+ growth, rising institutional ownership, and forward estimate upgrades, you’ll be positioned to ride early trends before they go mainstream.

Smart money leaves a trail. And when you track smart money the right way, you’ll uncover high-conviction setups and avoid the noise that throws off most retail traders.