Last Updated:

February 6, 2025

Why Watchlist Sections is a Game-Changer

Managing stocks effectively is essential for traders. The watchlist sections feature makes it easier to organize, categorize, and track stocks in one place. Whether you’re monitoring market indexes, top-performing stocks, or trade-ready setups, this feature simplifies your workflow.

Instead of juggling multiple watchlists with different themes, you can now create one structured watchlist with multiple sections making it easier to focus on the strongest stocks in each category. Plus, by grouping similar stocks together, you can analyze relative strength more effectively by comparing stocks side by side in seconds.

Whether you’re monitoring market indexes, top-performing stocks, or trade-ready setups, watchlist sections help you focus on the most important stocks at the right time. By grouping similar stocks together, you can analyze relative strength more effectively and spot high-potential trades in seconds.

How Staying Organized Keeps You Focused

Staying organized is key when building a watchlist. Without structure, it’s easy to feel overwhelmed and miss great opportunities.

As your watchlists grow, keeping them structured becomes even more important. By grouping similar stocks together in watchlist sections, you can quickly compare their movements and identify the best trade opportunities.

Streamline Your Attention With Watchlist Sections

Deepvue’s Watchlist Sections feature is a game-changer for traders looking to stay focused throughout the day. By organizing watchlists into sections, you can save time to focus on what truly matters: monitoring stocks and spotting trading opportunities.

With watchlist sections, you can easily separate different stock categories, such as market leaders, trending sectors, and speculative plays. This structure allows you to shift your focus as market conditions change, helping you stay ahead of key moves.

Keep a Daily Watchlist to Track Market Moves

Create a daily watchlist that you check throughout the day. Keep it open throughout the day so you can stay on top of price action and spot key movements as they happen.

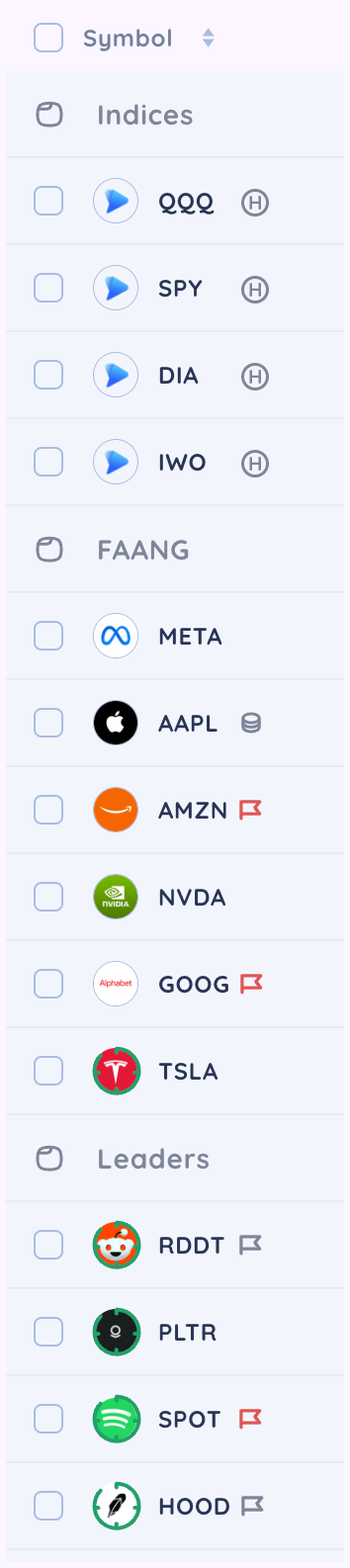

Watching major indices gives you a better sense of the overall market trend. Add a section for index ETFs and Leading Stocks, along with a ready-to-go list of potential setups for the day.

Monitor Emerging Themes to Find Strong Stocks

The leading stock in the leading sector will consistently outperform both the market and its competitors. When a stock moves in sync with a strong group, it benefits from that momentum.

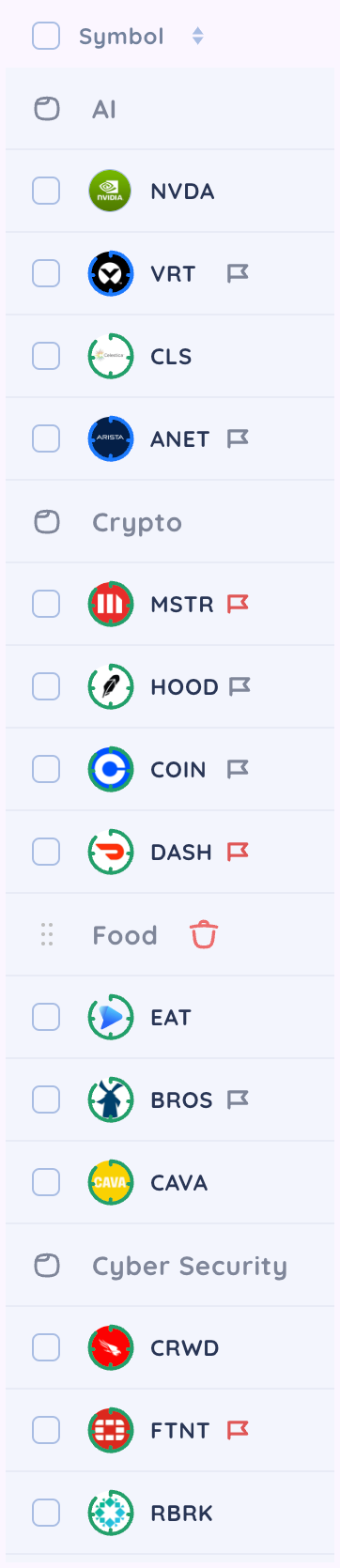

Use watchlist sections to highlight emerging themes like semiconductors, artificial intelligence, new food trends, and cryptocurrency to track strength as it develops. This allows you to compare stocks within each theme and identify the strongest names driving sector momentum.

Build a Focus List for Top Trading Opportunities

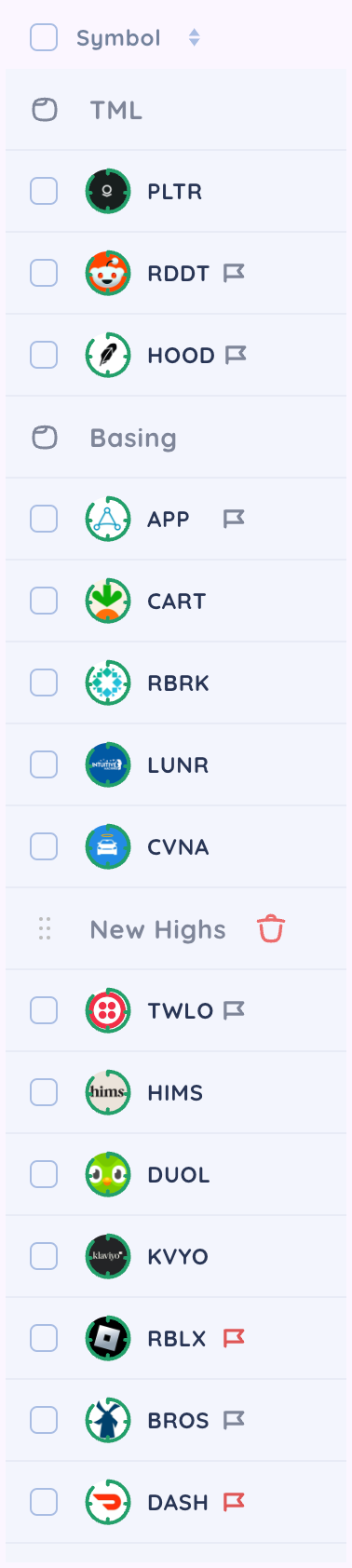

Your daily trading routine should center around narrowing your watchlist to the top 10 stocks. This list should include stocks that have already broken into new highs, as well as those setting up for a potential breakout.

Use watchlist sections to separate True Market Leaders – the stocks driving the current rally – from other setups that are approaching pivot points. This organization ensures that you’re always focused on the most actionable opportunities in the strongest stocks.

How to Create Watchlist Sections

Adding watchlist sections is simple.:

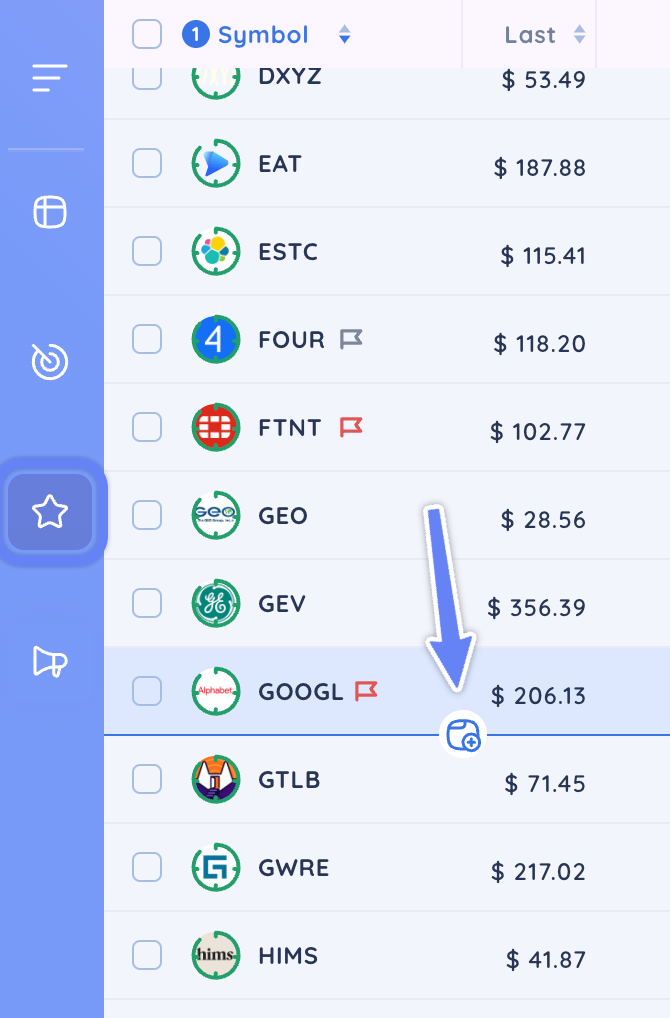

In any watchlist, hover your cursor between two tickers and look for the Sections Icon. Click on it to add a new section, then rename and rearrange it as needed.

By structuring your watchlist sections effectively, you’ll stay organized, react faster to market changes, and improve your trading process.

Key Takeaways to Optimize Your Watchlist With Sections

Watchlist sections simplify organization – Instead of managing multiple watchlists, you can structure one watchlist with sections to categorize stocks efficiently.

Stay focused on the strongest stocks – Grouping stocks by market leaders, emerging themes, or trade-ready setups helps you quickly identify the best opportunities.

Improve market analysis – By comparing stocks side by side within sections, you can analyze relative strength and spot high-potential trades faster.

Adapt to market changes with ease – Organizing stocks into sections allows you to shift focus as market conditions evolve, keeping you ahead of trends.