Last Updated:

August 5, 2025

Who is Matt Carusso?

Matt Caruso is a stock trader, educator, and financial expert with a deep passion for the stock market. His love for trading started young, sparked by reading How to Make Money in Stocks by William O’Neil.

Matt Caruso made headlines in 2020 when he earned a staggering 346% return during the U.S. Investing Championship. His performance during the chaotic COVID-19 market showed how adaptable and strategic he really is.

But Caruso’s success doesn’t stop with numbers. He’s also built a reputation as a trusted mentor in the trading world.

With years of hands-on experience trading independently since 2014, and a focus on education, he now shares his thoughts through his own Caruso Insights. He also appears regularly on other broadcast platforms, helping more traders learn what works.

What kind of trader is Matt Caruso?

Matt Caruso’s strategy sits between swing trading and position trading, meaning he holds stocks for weeks, months, or even years to ride out long-term trends. Unlike day traders or short-term swing traders, he focuses on the bigger picture.

His strategy combines fundamental analysis, including checking a company’s earnings and sales growth, with technical analysis, insisting that stocks are set up in proper basing patterns.

Caruso follows a strategy inspired by William O’Neil’s CANSLIM method, but with his own twist. He uses a series of risk management techniques and pyramiding, when he adds to positions only when his thesis proves right, and cuts out laggard positions quickly. This helps him grow profits while keeping risk in check.

Discipline is central to how he trades. He avoids emotional decisions, sticks to a clear plan, and always focuses on aligning his trading with his personal goals.

What types of stocks does Matt Caruso trade?

Caruso looks for growth stocks with strong fundamentals and big upside potential. He’s especially drawn to companies with explosive earnings or sales growth, often in new or fast-changing industries.

He likes stocks that show relative strength – ones that perform better than the market, even during downturns. His focus includes larger companies with strong growth potential, helping him maneuver positions quickly as conditions change.

By combining strong fundamentals with clear technical signals and disciplined risk control, Caruso has built a repeatable system that works. Whether you’re just getting started or looking to refine your approach, Matt Caruso’s strategies offer a roadmap for long-term success.

Why stocks with strong sales continue to grow

One of Matt Caruso’s core strategies is focusing on stocks with strong and growing sales. Huge sales numbers mean the company is actually selling its product and making money.

Over time, strong sales often lead to strong earnings. When a company consistently brings in more revenue, it can reinvest that money into expanding the business.

This kind of steady growth attracts more investors, which can drive the stock price even higher. It’s a signal the company is heading in the right direction.

How to screen for stocks with sales

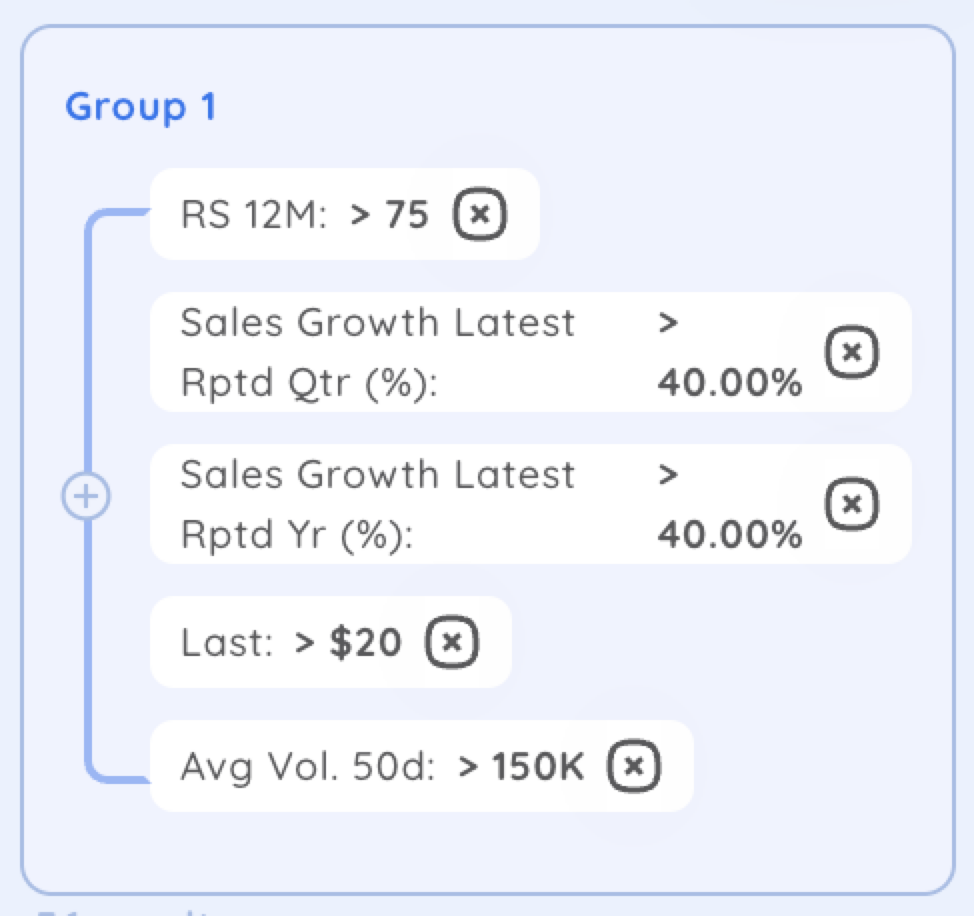

To find stocks with big sales growth, start by checking quarterly revenue numbers. Look for:

- Quarter-over-quarter sales growth over 40% – This shows the company is generating strong, recent momentum.

- Year-over-year sales growth over 40% – Longer-term sales growth proves the business isn’t just having a lucky quarter.

Include a Relative Strength (RS) rating to show that the stock is performing better than the overall market – a key sign of leadership.

How price contraction leads to price expansion

After a stock has made a big move up, the price will often pause, called a price contraction. Sellers step in to take profits, which causes the stock to trade in a tighter range.

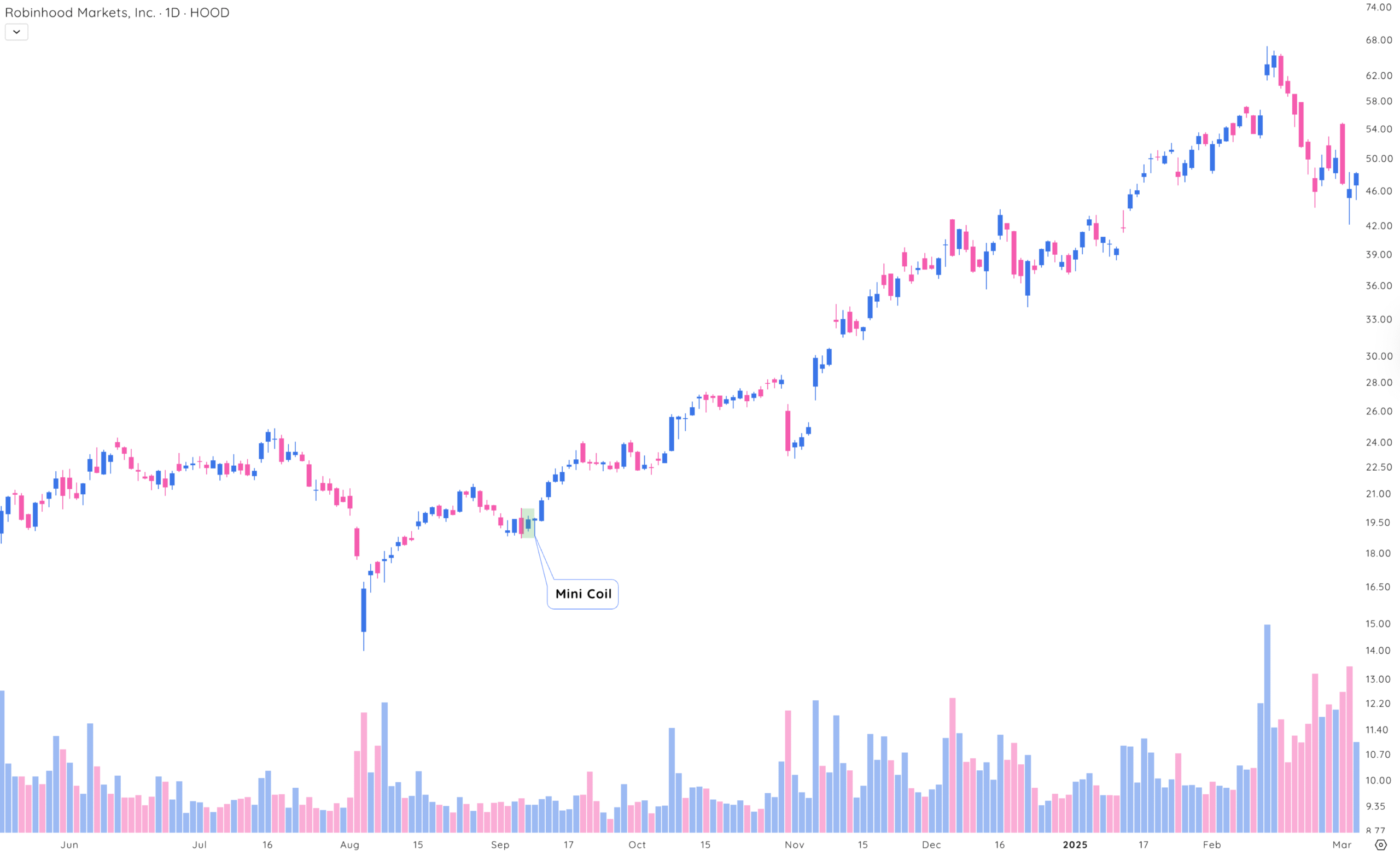

Eventually, that tight price action breaks, and most of the time, the breakout happens in the direction of the original trend. One pattern to look for is a mini coil, where the highs and lows of the last two days are inside the range of the third day.

A mini coil is a sign of consolidation and potential strength. These tight setups give traders a clear entry point and a defined area to manage risk.

How to screen for mini coils

Deepvue screeners make it easy to find well-known technical patterns with ease. You can simply add the mini coil technical pattern to any screener.

For the best setups, look for:

- Liquid stocks with strong average daily dollar volume

- Higher-priced names that institutions are more likely to trade

- High RS ratings to make sure you’re focusing on market leaders

Mini coil example:

Why IPO stocks have explosive growth potential

IPO stocks, those that just recently went public, often fly under the radar at first. But they’re usually fast-growing companies raising money to scale their products, hire talent, or expand their market.

Going public gives these companies a big boost in visibility, funding, and credibility. And when they start to show strong sales and earnings, smart investors take notice and pile in. That’s when explosive gains can happen.

These are the types of early-stage opportunities Matt Caruso looks for – before the rest of the market catches on.

How to screen for IPO stocks

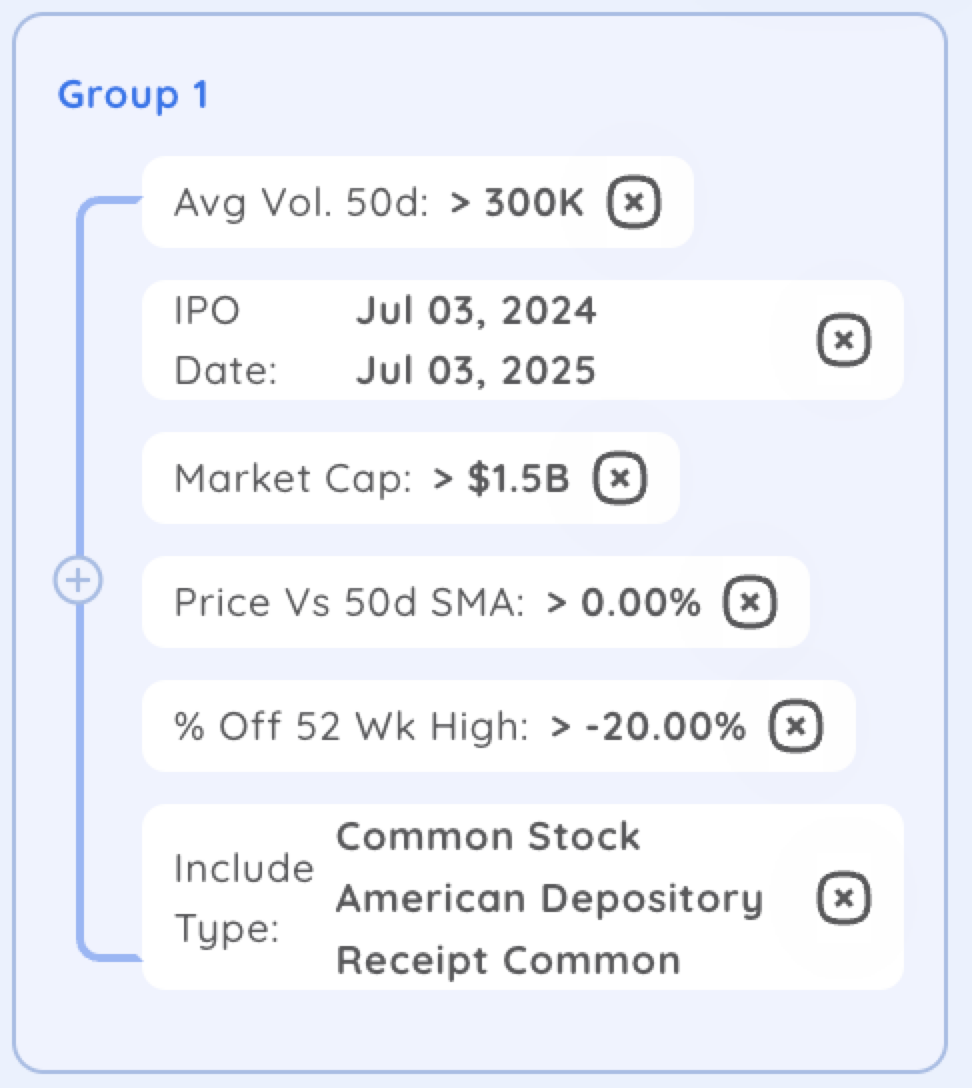

Finding IPO stocks is simple. Just search for companies with an IPO date within the past year.

To narrow down the list and focus on higher-quality names, apply filters for:

- Minimum market cap to avoid thin, risky names

- Solid average daily volume for better liquidity

- Strong RS ratings to find early leaders

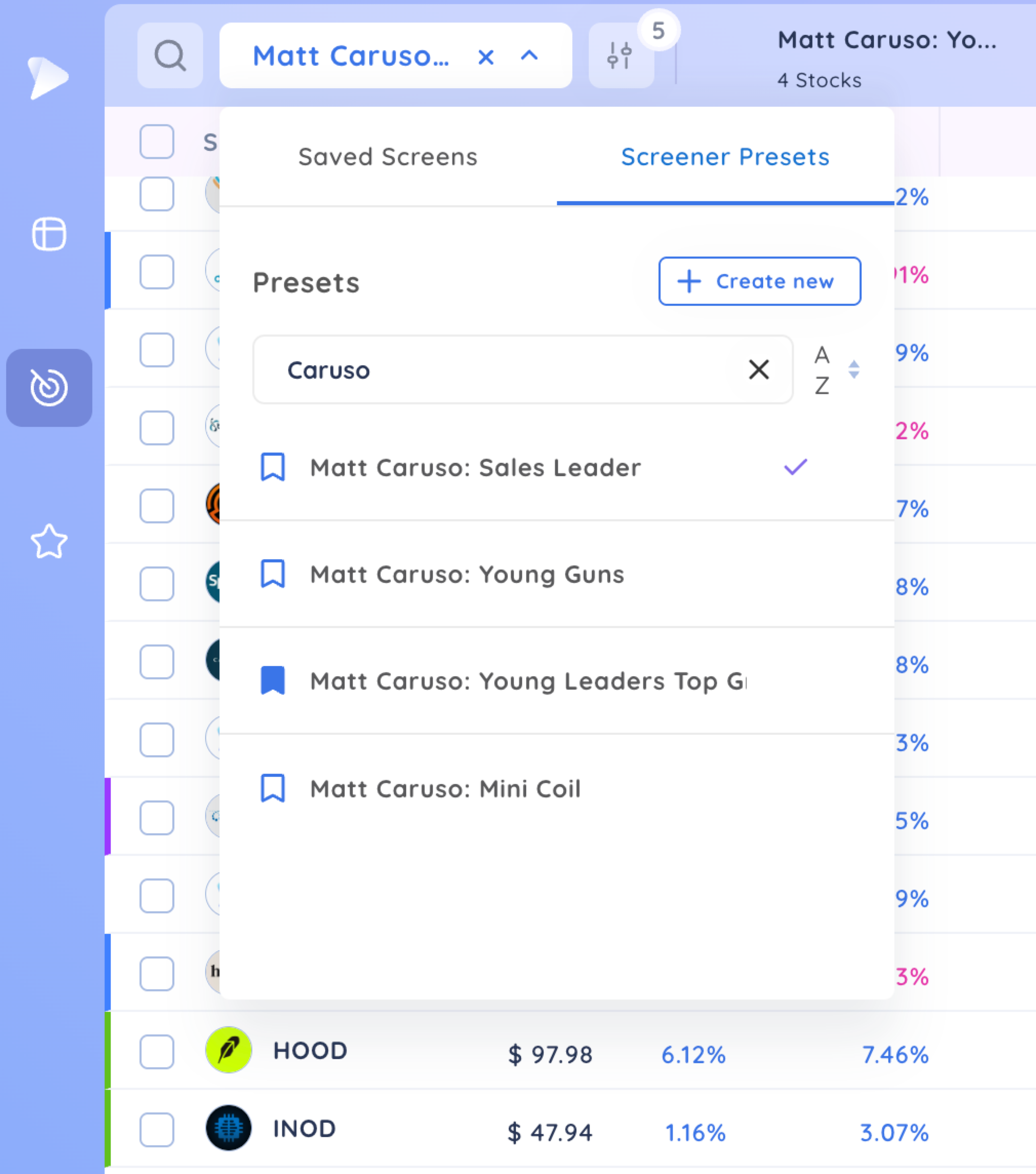

Using Matt Caruso screener presets in Deepvue

To make finding stocks easy, Deepvue partnered with Matt Caruso and other top traders to help you find stocks like the pros.

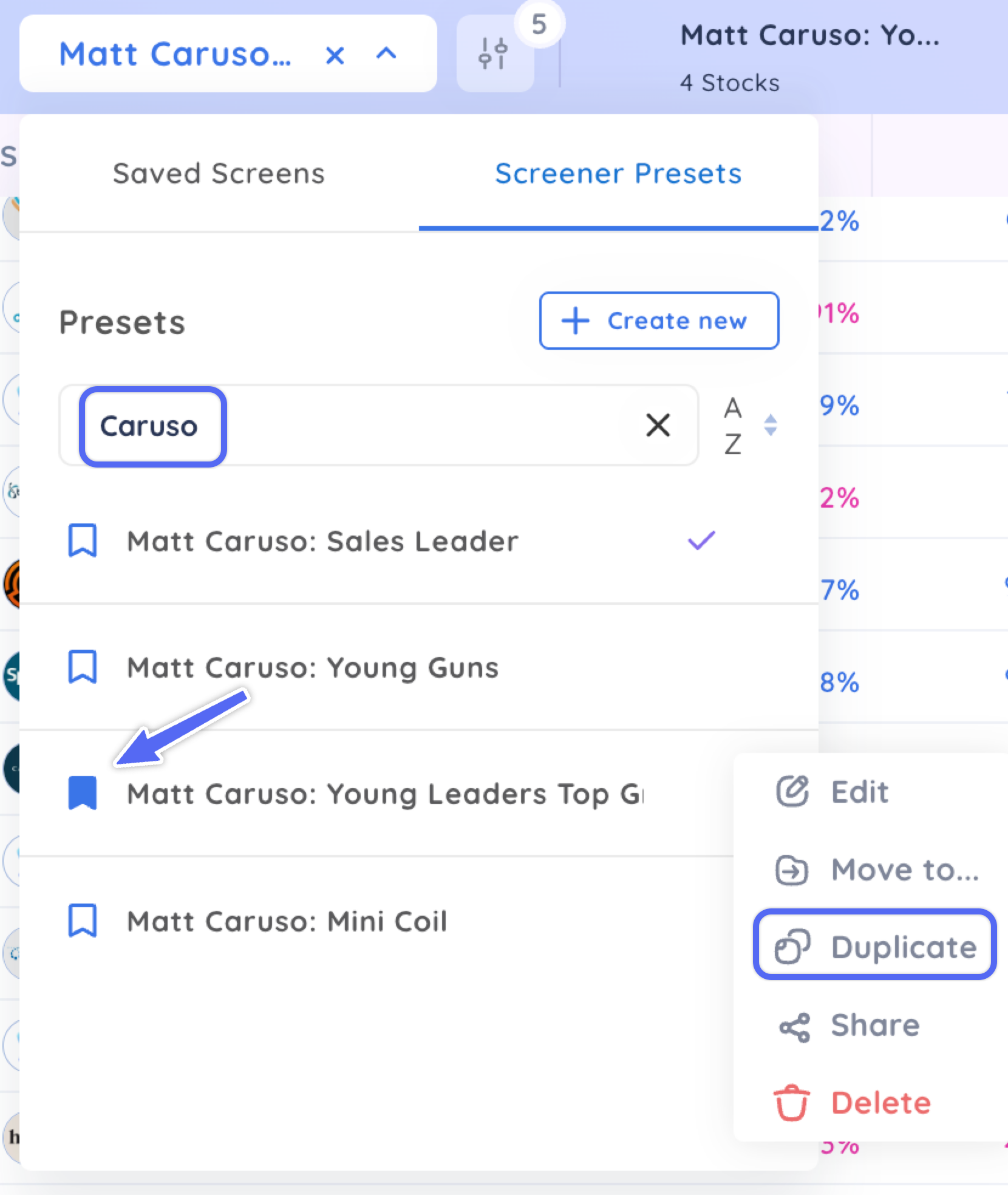

In the Screener module, navigate to the Screener Preset tab and type Caruso. You will see all the available screens Matt Caruso uses to find high-momentum stocks.

Bookmark any screen to pin it to the top of your screener module by clicking the bookmark icon. Click the three dots to duplicate any screen into your saved screens to make it your own.

Key takeaways from Matt Caruso’s strategy

Matt Caruso is a proven trader and mentor who gained recognition after a 346% return in the 2020 U.S. Investing Championship. His trading style blends swing and position trading, using both fundamental and technical analysis with strict risk management.

He focuses on growth stocks, especially those with explosive earnings or sales, and prefers stocks with strong relative strength.

Sales growth is a key indicator – companies with 40%+ quarter-over-quarter or year-over-year sales growth often become long-term winners.

Price contraction setups like mini coils signal potential breakouts and offer low-risk entry points for traders.

IPO stocks offer early-stage potential, especially once they prove their ability to generate sales and earnings.

Matt Caruso’s success comes down to a clear system – finding strong, growing companies, using technical setups that work, and managing risk with discipline.

With Deepvue’s screener presets, you can follow the same methods Matt uses to uncover top-performing stocks.