What the composite rating means for your stock picks

The composite rating is Deepvue’s proprietary all-inclusive rating, similar to other competitors’ unique ratings. While they’re similar, we put our own personal spin on this all-in-one rating.

The composite rating gives you a full picture by combining both a stock’s fundamental and technical strengths. It looks at things like Relative Strength, Absolute Strength, quarterly and annual fundamentals, and accumulation or distribution volume of the stock.

All of that data gets wrapped into one easy-to-use score. So instead of juggling multiple indicators, you can use the rating to quickly compare stocks across the market.

How the composite rating differs from other ratings

The composite rating provides a full picture by combining both fundamental and technical criteria. Most stock rating systems, on the other hand, focus on just one metric, either fundamentals or technicals.

That means you might get a great score based on earnings, but have to analyze the technicals to determine if the stock is actually being accumulated. Or maybe the chart looks strong, but the company’s financials are weak.

Deepvue’s composite rating takes a different approach. It blends both sides of the equation, technical momentum and financial health, into one easy-to-read score.

Here are the factors considered:

- Quarterly and annual fundamentals – These include earnings and revenue growth, profit margins, and return on equity. Key financial metrics that reveal financial growth.

- Relative Strength – Measures how a stock’s price is performing compared to others in the market. It’s a fast way to find leaders.

- Absolute Strength – Focuses on how the stock is performing on its own, without comparing it to others.

- Volume accumulation and distribution – This shows if big players (like institutions and funds) are buying or selling. That kind of activity can hint at where a stock is headed next.

All this data gets rolled into a single score, so you don’t have to bounce between different tools or reports. It’s a quick, reliable way to size up a stock and stack it against the rest of the market, especially useful when you’re filtering for top performers.

Why understanding the composite rating matters

If you’re serious about picking strong stocks, understanding the composite rating is essential. It gives you a complete view of both a company’s fundamentals and its price action.

Instead of relying on gut instinct or one-off data points, you get a clear, data-backed score that simplifies your decision-making.

The composite rating helps you:

- Spot market leaders early by identifying stocks with strong fundamentals and upward price momentum.

- Avoid weak performers that might look good on the surface but are being sold off by institutions.

- Make faster decisions with a clear, at-a-glance score that cuts through the noise.

- Build watchlists based on real strength, not hype.

And because Deepvue offers the composite rating across multiple time frames, you can match it to your investing style:

- 1-month rating – Great for short-term traders or swing traders looking to catch quick momentum shifts.

- 3-month rating – Useful if you’re trading mid-term trends or holding positions for several weeks.

- 6-month rating – Perfect for investors who want to track an intermediate-term evaluation of a stock and smooth out short-term volatility.

- 12-month rating – Best for long-term investors who care more about overall strength and consistent growth over time.

Each time frame helps you understand how consistent a stock’s performance has been and whether it’s gaining or losing strength. So whether you’re trading quickly or building a portfolio for the long haul, the rating gives you a smart, flexible tool to stay on the right side of the market.

💡 Pro Tip: Top-performing stocks typically boast a composite rating above 80, with the strongest stocks frequently displaying a rating of 90 or higher prior to significant upward trends.

How the composite rating helps find strong stocks

In practice, a high composite rating shows that a stock has strong upward momentum with growing fundamentals. This can be a sign that the stock might continue to do well in the future.

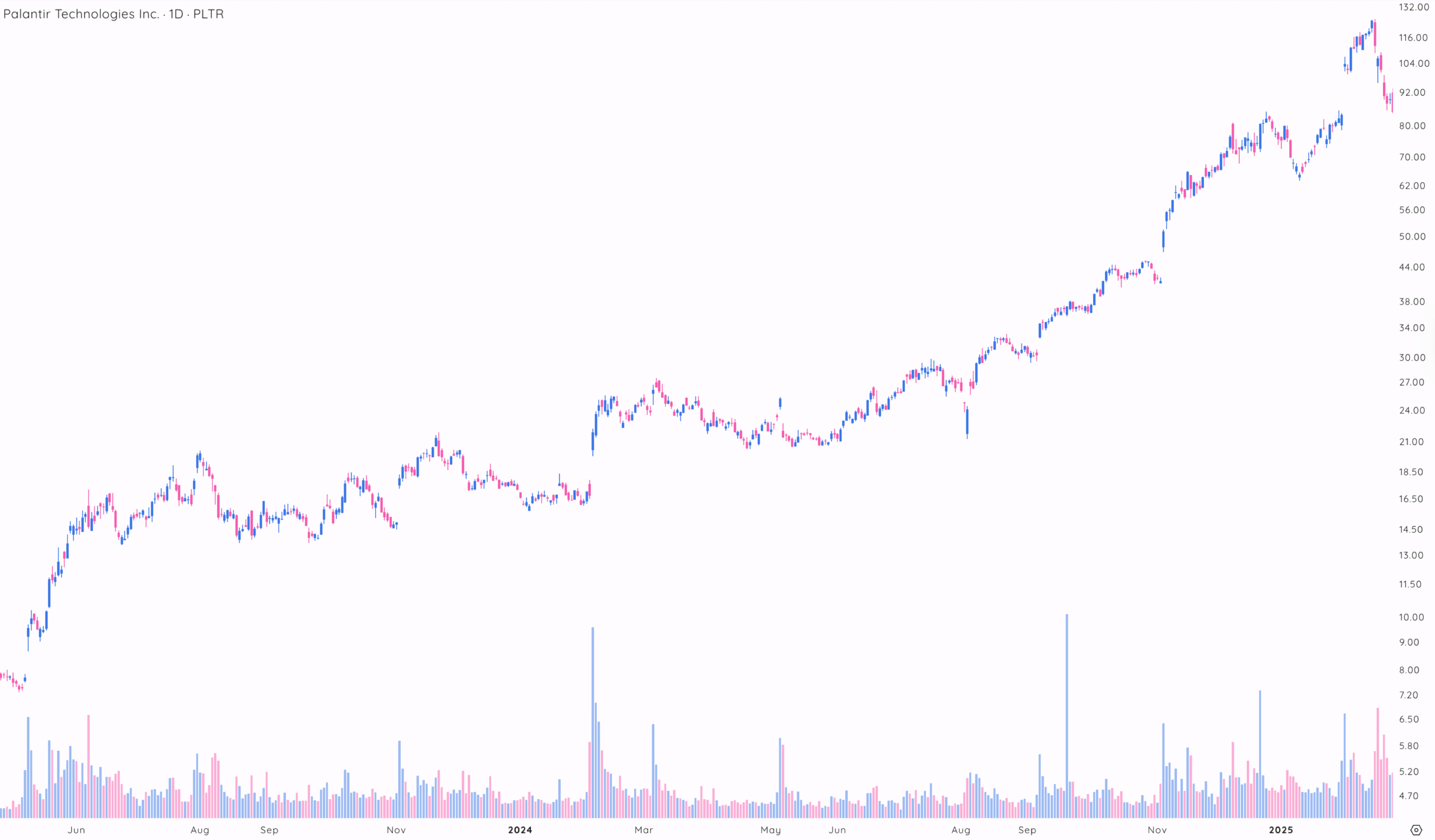

The leading growth stock of 2024 had a composite rating of 95 across all timeframes as it progressed into new all-time highs.

On the flip side, a low rating suggests a lack of demand. These stocks might underperform in the future, making them candidates for avoiding or even short selling.

During the same time period, this laggard had a composite rating under 50 while it went sideways for over a year.

Identifying the strongest stocks on your watchlist

By understanding and utilizing Deepvue’s composite rating, investors can target stocks likely to outperform their peers in the market. This metric not only aids in identifying stocks with strong performance but also helps in recognizing financial growth.

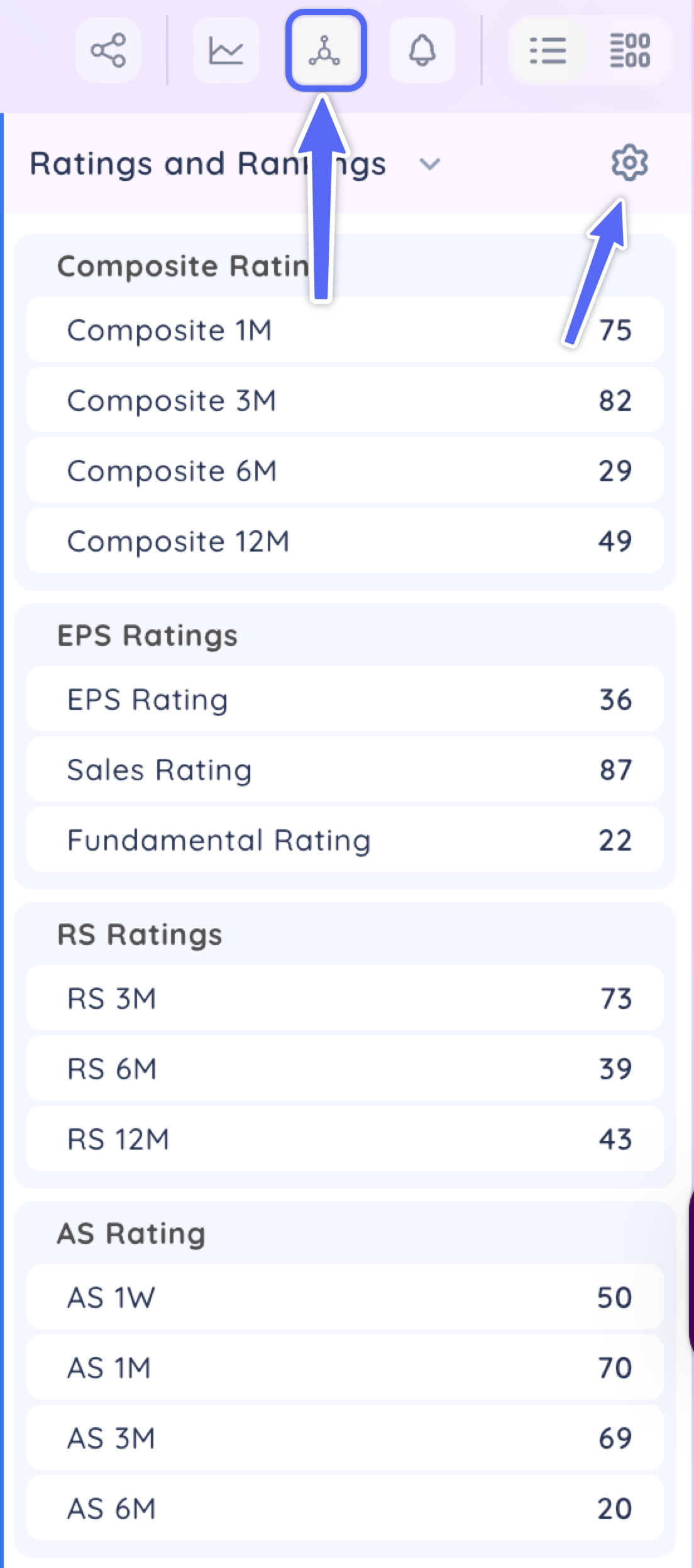

Adding composite ratings to your data panel

Click on the Data Panel Icon to open all customizable settings.

To optimize your trading strategy, design a tailored Data Panel focused on composite ratings. Here’s how you can customize it:

- Select Your Timeframe: Adjust the periods for which you want to analyze Relative Strength. This flexibility allows you to align the composite rating with your trading horizon, whether you’re a day trader, swing trader, or long-term investor, by focusing on 1 month or multiple months.

- Integration With Your Trading Strategy: If your strategy involves other factors like volume, volatility, or fundamental data, integrate these ratings into your data panel alongside other performance metrics. Add the composite rating to accompany EPS and Sales data, ADR or ATR percentages, and Average Volume.

Adding composite ratings to your column settings

In a similar fashion to the Data Panel, Deepvue users can create custom Column Settings to tailor to their needs.

To enhance your trading approach, create a custom Data Panel centered on the composite rating. Here’s how you can adapt it:

- Timeframe Comparisons: Compare how the composite rating has changed from a shorter to a longer timeframe. Choose the periods over which you analyze charts and look for an increase in the rating over time.

- Compare Other Ratings: Use the Relative Strength, Earnings Per Share, and Absolute Strength Ratings to compare the composite rating.

- Add Other Momentum Indicators: Create a quick visual for analyzing the strength of a stock’s trend. Add Daily and Weekly Closing Ranges, Volume Run Rate, and other Industry Rankings.

Personalizing your Data Panel and Column Settings with these elements enables powerful tools at your fingertips to help identify the best stocks by focusing on strength. With these personalized settings, your dynamic workspace helps quickly filter stocks to easily analyze and react to stock performance trends.

How to find strong stocks: screening for stocks with high composite ratings

Whether you’re a new investor or an experienced trader, understanding Deepvue’s composite rating can help you navigate the stock market more effectively. Incorporate the composite rating into your screening routine to ensure you are looking at stocks outperforming the market.

Look for stocks that have a rating of 80 or above with simple liquidity parameters.

Look for stocks that have a rating of 80 or better across multiple timeframes.

Key takeaways: Why the composite rating deserves your attention

The composite rating isn’t just another number on a stock screen – it’s a powerful tool that brings everything together. By blending both technical momentum and financial health into one easy-to-understand score, it helps you quickly spot leaders, and avoid laggards.

Here’s a quick recap of what makes the composite rating so useful:

- It’s all-in-one: You don’t have to juggle separate indicators. The rating rolls in key metrics like earnings growth, relative strength, absolute strength, and institutional volume trends.

- It saves time: With one glance, you can spot stocks worth watching—no need to dig through dozens of charts and financial reports.

- It’s flexible: Choose from 1-month, 3-month, 6-month, or 12-month versions to match your trading style and timeframe.

- It’s reliable: Stocks with high ratings (especially 90 or above) often show strong performance before big moves. That makes it a great signal for early entry or confirmation.

Whether you’re building a new watchlist or fine-tuning your strategy, Deepvue’s composite rating helps you stay focused on the stocks with real strength. It gives you an edge by helping you act on data, not guesswork.