Why Sales Growth Matters

In the search for market-beating returns, one metric stands above all others: sales growth. While Wall Street obsesses over earnings reports, the smartest investors also focus on the revenue numbers that cannot be manipulated.

Understanding how to evaluate revenue growth separates those who consistently identify tomorrow’s market leaders from those perpetually chasing yesterday’s news. Earnings capture headlines, but sales tell a different story.

Net income can be distorted by financial restructuring, asset sales, tax benefits, and accounting adjustments. Revenue is different. Companies either generated top-line sales or they didn’t. There’s no way to manufacture sustained revenue growth through accounting creativity.

A company posting strong earnings while sales decline is often cutting costs or benefiting from one-time accounting decisions. The business is getting smaller, not stronger.

Conversely, consistent sales growth demonstrates genuine customer demand – the foundation upon which everything else is built. Strong revenue growth today creates conditions for rising earnings tomorrow.

Why Institutional Investors Prioritize Sales Growth:

- Revenue requires real customer demand. It can’t be manufactured through adjustments.

- Rising revenue creates operating leverage that naturally flows to future earnings.

- Institutions accumulating positions over months need confidence in sustainable momentum.

- Companies with declining sales rarely sustain stock price gains.

Year-Over-Year Sales Growth

When evaluating sales growth, comparing results year-over-year (YOY) provides meaningful analysis. This approach eliminates seasonality because comparing a holiday-heavy Q4 to a slow Q3 produces misleading conclusions.

True revenue growth only becomes visible when measured against the identical seasonal period from the prior year.

Consider a consumer electronics company reporting 40% quarter-over-quarter revenue growth from Q3 to Q4 thanks to holiday shopping. Impressive until you realize last year’s Q4 was even stronger, meaning the company is actually losing market share.

Only YOY comparisons reveal the truth. Every industry experiences unique seasonal patterns.

Software companies often see Q4 strength as enterprises exhaust annual budgets, retailers peak during holiday shopping, and agricultural businesses fluctuate with growing seasons. Without YOY comparisons, these natural rhythms create noise that obscures whether the business is genuinely growing.

Beyond quarterly data, tracking annual sales growth over multiple years provides essential context. Companies achieving three consecutive years of 25%+ growth have demonstrated their business model works at scale.

These companies have proven that demand remains strong as they grow and that competitive advantages are sustainable.

Quarter-Over-Quarter Acceleration: Catching Breakouts Early

While year-over-year sales growth provides the foundation, quarter-over-quarter sales acceleration often signals something transformational. Acceleration means the rate of growth itself is increasing, creating a compounding effect that attracts institutional capital and drives stocks from good performers to market leaders.

When a company grows revenue 20% one quarter, then 25% the next, then 32%, then 40%, the absolute dollar increases are compounding on a larger basis while percentage rates also expand. This double compounding demonstrates business momentum that institutions recognize as sustainable.

Pro Tip: If you’ve got acceleration in sales, it means something new is going on. That catalyst creates the conditions for substantial price appreciation that most investors miss until it’s obvious in the price chart.

What Drives Sales Acceleration

Groundbreaking products launch and begin gaining market acceptance. Initial sales are modest, but as distribution expands and word spreads, growth rates accelerate exponentially. This pattern appeared with Apple’s iPhone, Tesla’s Model 3, and Zoom during remote work adoption.

Companies successfully expanding into new geographies or customer segments experience accelerating sales. Each new market adds incremental revenue while existing markets continue growing, creating compounding expansion.

Understanding what drives acceleration helps investors assess sustainability. Specific business developments create the conditions for expanding growth rates.

Just as acceleration signals improving momentum, deceleration warns of deteriorating conditions. A company showing 45%, 38%, 32%, and 26% YOY declines over four quarters shows slowing revenue growth.

Even though 26% sounds strong, the trend reveals momentum fading. This pattern often precedes multiple declines and stock price weakness as institutions recognize that the best growth is behind the company.

How Sales Growth Affects a Stock’s Price

Sales growth is often the engine behind major stock moves. When a company’s revenue keeps climbing, its stock price usually follows.

So when you’re analyzing stock charts, don’t just focus on patterns. Look at the fundamentals too, especially sales trends that hint at future gains

The three key sales metrics to watch are:

- Year-over-year (YoY) growth

- Quarter-over-quarter (QoQ) growth

- Accelerating sales growth

Let’s take a look at three real-world examples where rising sales directly impacted stock performance.

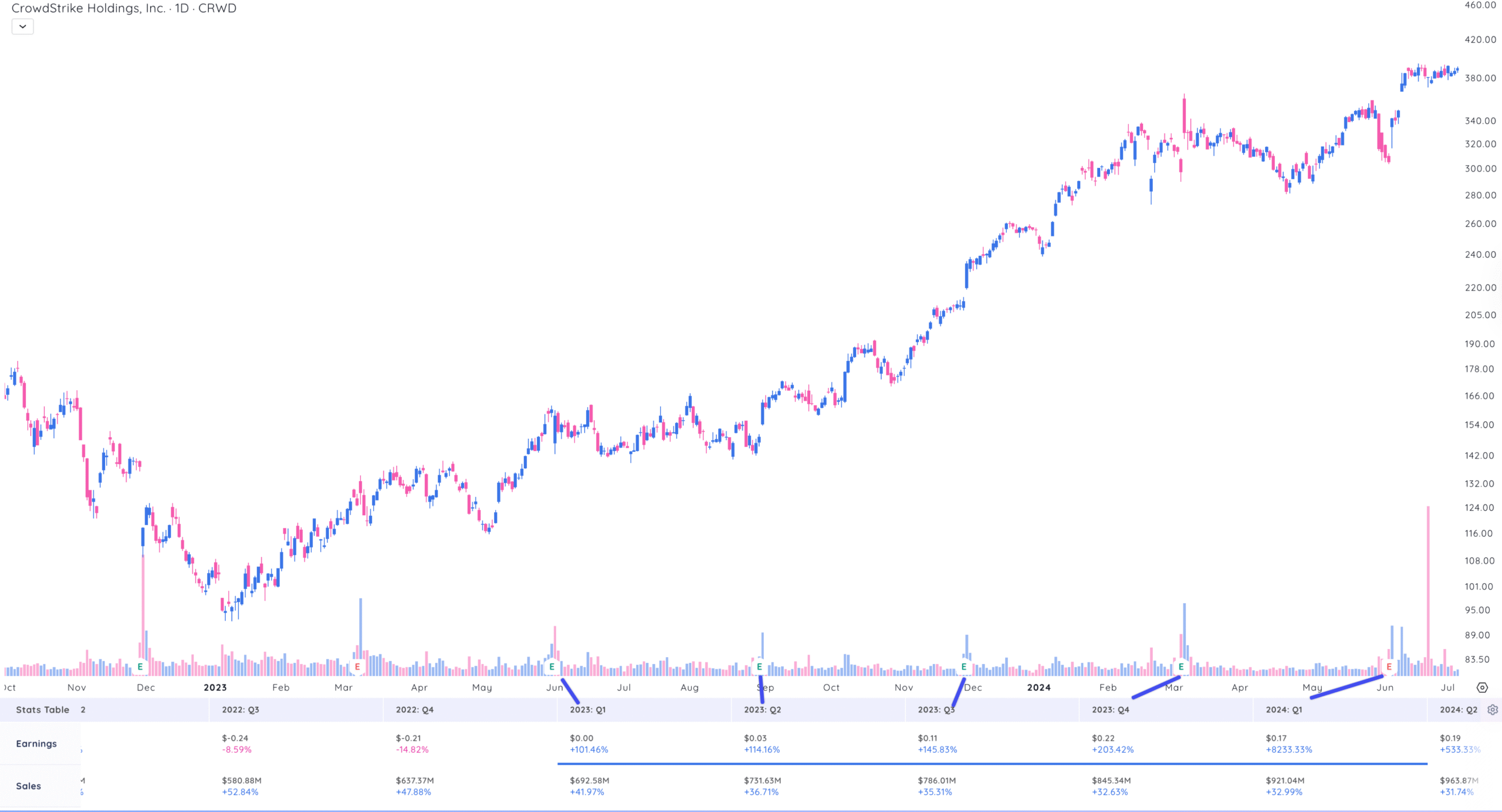

Coming out of the 2022–2023 bear market, CrowdStrike stood out as one of the top-performing cybersecurity stocks. What drove that performance? Sales growth.

CRWD posted steady increases in both QoQ and YoY revenue. This consistent growth gave investors confidence, and the stock responded. Over just six months, CRWD climbed 125%, showing how fundamental strength can power big technical breakouts.

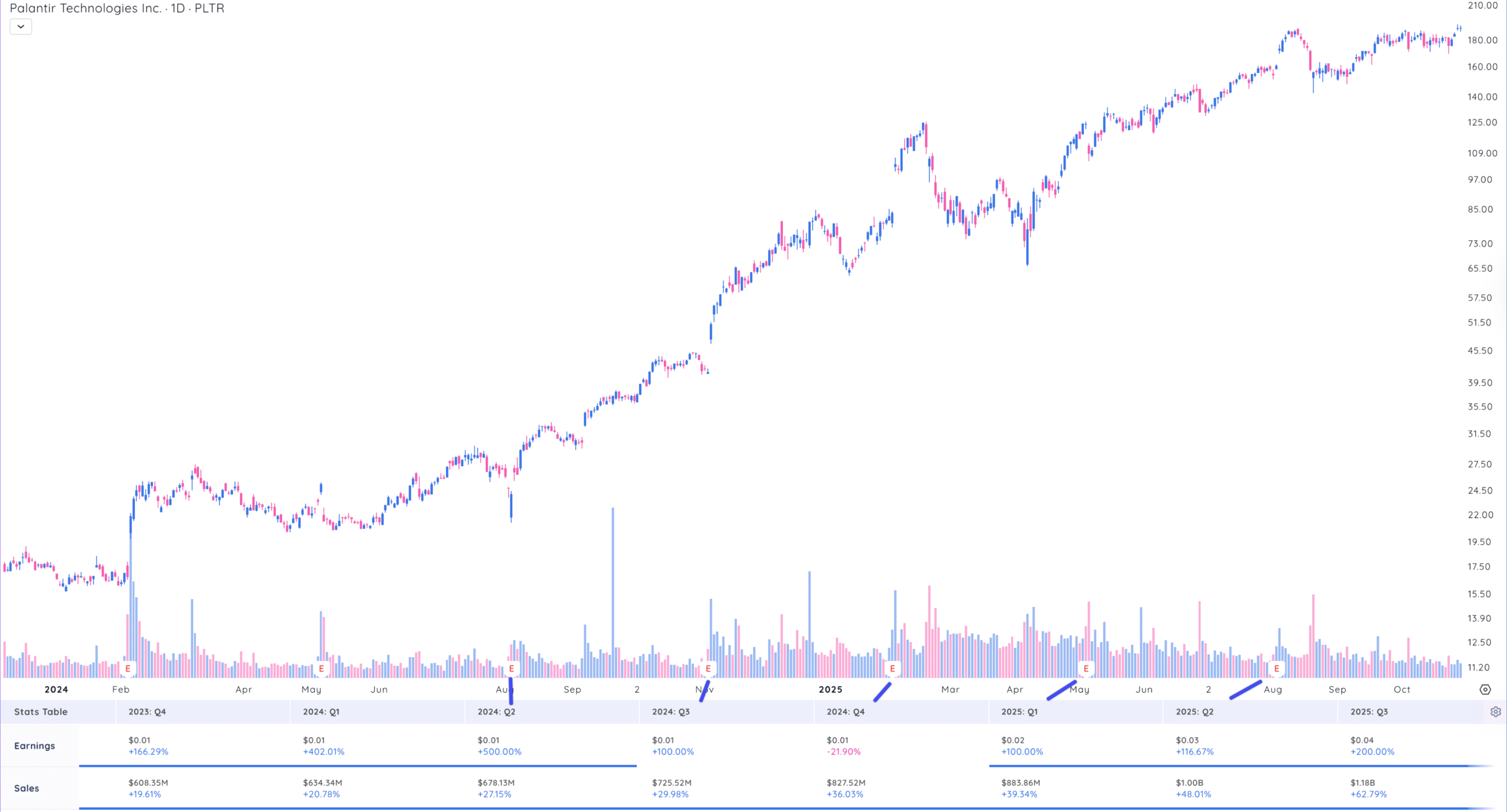

At first, Palantir’s earnings report sparked a negative reaction. But that changed fast. Once investors dug into the numbers, they saw something more important: accelerating sales growth.

By Q2 of 2024, Palantir had racked up four straight quarters of faster and faster revenue growth. Forward guidance looked even stronger. That shift flipped sentiment, and PLTR exploded, jumping 420% in just six months from the August 5, 2024 market close.

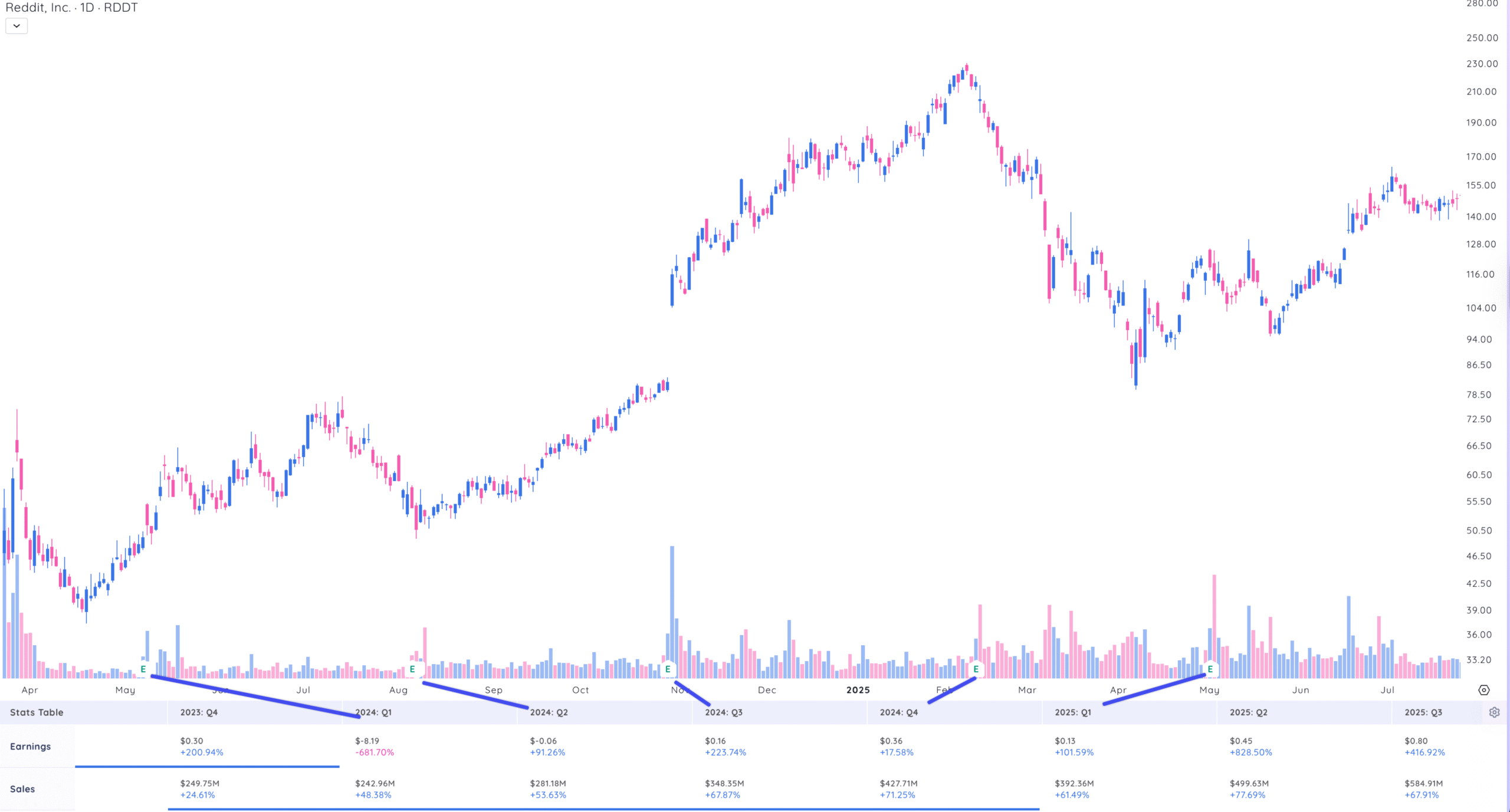

After Reddit’s IPO in 2024, the company quickly made headlines with a strong earnings report showing solid sales growth. But things got even more interesting after the next few quarters.

RDDT showed three straight quarters of accelerating revenue – something investors love to see in a newly public company. That momentum helped push the stock up 280% over five months during its IPO Advance Phase.

Screening for Sales Growth Leaders

Strong one-off quarters can be misleading. Instead, investors should look for sustained sales growth over multiple quarters to identify companies building long-term momentum rather than experiencing temporary spikes.

A comprehensive screening approach combines both consistency and acceleration.

Sales Growth Screening Criteria:

- Quarterly Sales Growth (YOY) – greater than 25%

- Sales Acceleration – 3 rising quarters preferred

- Annual Sales Growth – greater than 25%

- Total Annual Revenue – greater than $100 million

Multi-Quarter Consistency Pattern:

The ideal revenue growth profile shows strength across multiple timeframes, demonstrating that momentum is building rather than fading. Here’s what consistent growth looks like:

- Last quarter: +40% sales growth

- Average last 2 quarters: +35% sales growth

- Average last 3 quarters: +30% sales growth

- Average last 4-6 quarters: +25% sales growth

This pattern reflects a company that’s not just hot now, but building accelerating momentum. The most recent quarter exceeds the longer-term averages, showing improvement rather than deterioration.

Putting Sales Growth Into Practice

One of the hardest aspects of fundamental investing is psychological – buying stocks that appear expensive on traditional valuation metrics but are reasonably valued based on future earnings power. A company growing revenue 40% annually that trades at 50x current earnings might trade at only 20x two years forward if execution continues.

While earnings, profit margins, return on equity, and other metrics all contribute to analysis, revenue growth forms the foundation. It’s the cleanest, least manipulated metric of a company’s true performance.

Sales growth gives you the conviction to own these stocks through volatility, but most investors can’t get comfortable with the current multiple and miss the opportunity.

Understanding sales growth principles is valuable, but implementation separates consistent winners from those who merely understand theory. The most successful growth investors develop systematic processes for finding, evaluating, and monitoring revenue leaders, then execute with discipline when opportunities present themselves.

This is where sales analysis provides invaluable psychological anchoring. When a stock you own pulls back 15-20% despite maintaining strong revenue growth and acceleration, you have objective evidence that the weakness is technical rather than fundamental.

This allows you to hold or even add to positions while others panic. Conversely, when sales decelerate, you have clear evidence to sell even if price momentum remains strong temporarily.

Final Thoughts

Sales growth is the cleanest metric. Revenue cannot be manufactured through accounting and represents genuine customer demand.

Always compare sales year-over-year to eliminate seasonal distortions and reveal true momentum.

Top stocks demonstrate at least 25% YOY sales growth. This threshold separates exceptional from good.

Sales acceleration over three or more quarters signals improving momentum and often precedes major breakouts.

Screen for both consistency (all periods above 25%) and acceleration (recent exceeding longer-term averages).

When sales decelerate, exit positions even if price momentum remains.