Last Updated:

December 21, 2025

Why Did William O’Neil Track Relative Strength?

William O’Neil turned $5,000 into $200,000 by trading three exceptional stocks in the early 1960s. His secret weapon? Relative strength. Through decades of research, O’Neil discovered that top-performing stocks shared a common trait before their biggest price gains: they were already outperforming the market.

Today, traders and investors use relative strength stocks to identify market leaders, spot institutional accumulation, and position themselves for the next big move. Whether you’re a swing trader looking to catch momentum or a position trader building a portfolio of winners, understanding relative strength is essential to achieving superperformance.

In this guide, you’ll learn exactly how to find, analyze, and trade relative strength stocks using proven techniques that have worked for decades.

What Is Relative Strength and Why It Matters

Relative strength measures how a stock performs compared to a benchmark, typically the S&P 500 or Nasdaq Composite. Unlike lagging indicators that trail price action, relative strength is a leading indicator that reveals underlying demand before price breaks out.

When a stock shows strong relative strength, it rises more than the market during rallies and falls less during corrections. This behavior signals institutional accumulation when large investors quietly build positions in their highest conviction ideas.

Strong vs. Weak Relative Strength

- Strong Relative Strength: If the market rises 10% and a stock rises 20%, that stock demonstrates relative strength. If the market falls 10% and a stock only drops 5%, it’s still showing strength by declining less than the broader market.

- Weak Relative Strength: A stock that rises only 5% when the market advances 10% shows relative weakness. Similarly, a stock that drops 20% when the market falls 10% is a laggard you should avoid.

The RS Rating: Your Shortcut to Finding Leaders

The RS Rating ranks a stock’s price performance on a scale of 1 to 99. A rating of 90 means the stock is outperforming 90% of all other stocks over a specific period. This simple metric cuts through the noise and instantly identifies which stocks are leading the market.

Focus on stocks with an RS Rating of 80 or higher. The strongest performers often display ratings above 90 before they begin significant uptrends. By screening for high RS Ratings, you’re immediately filtering your universe down to proven outperformers.

Multiple Timeframes for Complete Analysis

Different timeframes serve different trading styles. Short-term RS ratings (1-month and 3-month) capture quick momentum bursts, making them ideal for swing traders and identifying newly listed IPOs with explosive moves. Medium-term RS (6-month) offers a balanced view of sustainable trends. Long-term RS (12-month) is essential for position traders and aligns with strategies like CANSLIM, where investors seek stocks with enduring strength.

Pro Tip: Look for stocks with high RS Ratings across multiple timeframes. When a stock shows strength at 1-month, 3-month, 6-month, and 12-month periods, you’ve found consistent momentum that often continues.

5 Ways to Screen for Relative Strength Stocks

Finding relative strength stocks doesn’t require guesswork. Here are five proven screening techniques to identify market leaders in real time.

1. RS Line New Highs

The Relative Strength Line visually represents how a stock performs versus the market. When this line makes a new high, it signals the stock is outperforming even if the price hasn’t reached new highs yet.

Stocks with RS Lines at new highs often lead their sectors and attract institutional buying, making them prime candidates for significant gains.

2. RS Line New High Before Price

This is one of the most bullish signals a stock can give. When the RS Line breaks to new highs while the price is still consolidating, it indicates the stock is already outperforming and gearing up for a breakout.

During weak market conditions, a clear sign of institutional accumulation occurs when the strongest stocks move sideways, while their RS Lines trend higher.

3. Count Relative Strength Days

Relative Strength Days are trading sessions when a stock outperforms the market. By tracking how often a stock closes stronger than the index, you can identify consistent leaders.

The magic number is 60%: stocks that exhibit RS Days over 60% of the time during market corrections are potential leadership stocks for the next rally.

4. Highest Volume in a Year

Volume confirms conviction. When a stock experiences its highest trading volume in over a year alongside strong price action, it signals powerful institutional interest.

This combination of relative strength and volume often occurs at critical turning points like at the start of new uptrends or breakouts from bases.

5. Stocks Up on Down Days

The simplest screen is often the most powerful. On days when the market sells off, look for stocks that finish green. This behavior demonstrates exceptional demand that outweighs general selling pressure.

These resilient stocks are typically the first to rebound when market conditions improve and often become the next cycle’s leaders.

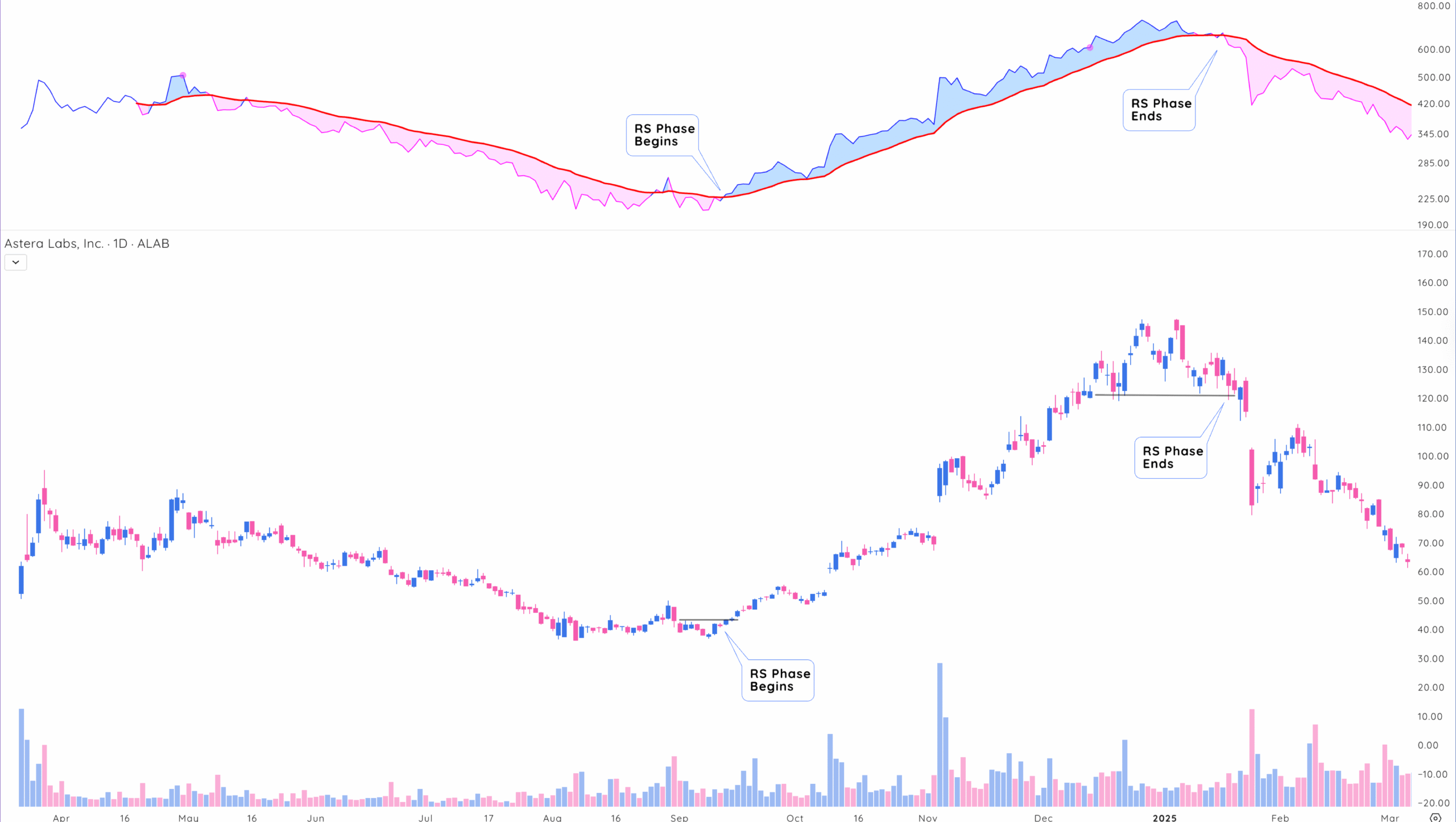

The Relative Strength Phase: Early Entry Edge

The RS Phase represents a period when a stock consistently shows strength compared to the market. It occurs when a stock’s RS Line moves above its 21-day exponential moving average (EMA) and stays there. This signals sustained outperformance rather than a temporary spike.

During market corrections, most stocks pull back. But stocks in an RS Phase either hold their ground or fall less, demonstrating resilience.

These are often the stocks being quietly accumulated by institutions, and they’re typically the first to break out when the market turns.

How to Identify an RS Phase Setup

- RS Line above the 21-day EMA: This shows steady outperformance, not a one-day pop.

- RS Line making new highs: Indicates large funds are building positions.

- RS leads price action: The RS Line often breaks out before price, giving you an early warning of potential moves.

The RS Phase isn’t just a buy signal. It can also warn when to sell.

After a prolonged uptrend, when the RS Line drops below its 21-day EMA and the RS Phase ends, it’s time to get defensive.

Why O’Neil Made Relative Strength His Foundation

William O’Neil’s research on historical stock market winners revealed a crucial pattern. In his study of 500 top-performing stocks from 1953 to 1985, he found that the average stock had a relative strength rating of 87 before its major price advance.

This wasn’t a coincidence. It was a consistent characteristic of winning stocks.

O’Neil built this insight into his CANSLIM methodology, where the “L” stands for “Leader or Laggard.” His rule was simple: only buy stocks with an RS Rating above 80, and ideally focus on those with ratings of 90 or higher with chart-based patterns.

He warned against buying “sympathy” stocks that appear cheaper but lack relative strength, as they often continue to lag while true leaders surge higher.

The Bottom Line: Relative Strength Stocks are Winners

Relative strength stocks represent the market’s strongest performers, where the institutions are accumulating and that lead each new rally. Unlike many technical indicators that lag price, relative strength is forward-looking.

Relative strength stocks reveal demand before breakouts occur and warn of weakness before major declines.

William O’Neil’s research proved that targeting stocks with high relative strength dramatically improves your odds of success. By focusing on RS Ratings above 80, watching for RS Line new highs, counting RS Days, and identifying the RS Phase, you align your trading with the same principles that have identified winning stocks for decades.

Whether you’re swing trading momentum or building a position trading portfolio, relative strength should be at the core of your stock selection process. The best stocks refuse to fall when the market is weak.

Find relative strength stocks, and you’ve found potential market leaders.

Putting It All Together: Your RS Trading Framework

Here’s how to integrate relative strength into your daily trading routine:

Combine RS with fundamentals. The most powerful setups occur when strong relative strength meets accelerating earnings and sales growth. A stock with a high RS Rating and improving fundamentals is a prime candidate for your portfolio.

Build your watchlist on down days. When the market sells off, screen for stocks that are green or holding up. These are your relative strength stocks—the ones showing demand when everything else is under pressure.

Focus on RS Ratings above 80. Filter your universe to stocks outperforming 80% of the market. This immediately narrows your focus to proven leaders.

Watch for RS Line breakouts. When the RS Line makes new highs, especially before the price, it’s a signal of strength. Add these stocks to your watchlist for potential entry.

Count RS Days during corrections. Track which stocks show RS Days over 60% of the time. These are your candidates for leadership when the market turns.