Sell Smarter: 3 Moving Averages to Help Lock In Gains and Protect Capital

Deepvue

Last Updated:

November 4, 2025

Selling Rules System with Moving Averages

We’ve all been there.

You buy a strong stock, ride the wave up, and watch your unrealized gains pile up, only to see them vanish days later.

That 50% winner? It’s now breakeven, or worse, now a losing trade.

But what if you had a system that helped you lock in profits while the stock is strong, and cut losses before they spiral out of control?

The answer lies in moving averages. Not just for spotting great entries, but for making smart exits too.

Why Moving Averages are Your Ultimate Exit Tool

Moving averages aren’t just lagging indicators—they can be a part of your built-in sell system. They give you clear, repeatable signals based on price behavior.

And best of all? They take the emotion out of your decisions.

Here’s how moving averages can help you sell:

In this post, we’ll break down both sell types, show you how to apply them using Deepvue, and help you build a rule-based selling strategy you can start using today.

Offensive Selling: Sell Into Strength Before the Pullback

Offensive selling is about selling when the chart looks strongest, not weakest.

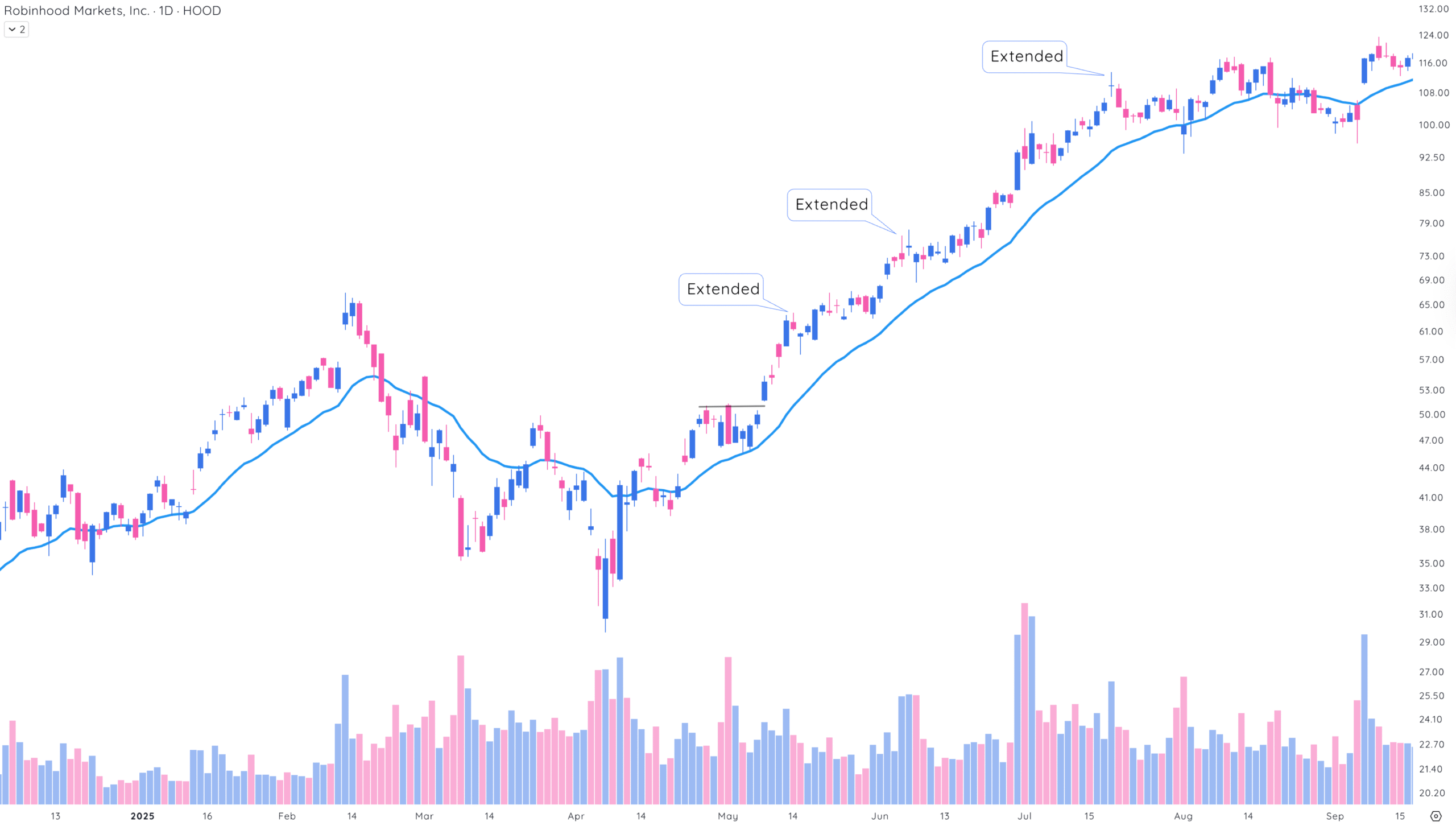

In Oliver Kell’s Cycle of Price Action model, strong stocks typically push 2 to 3 times above their key moving averages before they top out. These are moments of euphoria, when price stretches far from its average, and that’s when smart traders quietly take profits.

Why sell offensively?

- Lock in gains before the crowd realizes the top is in.

- Free up capital to rotate into new opportunities.

- Avoid giving back hard-earned profits during the inevitable pullback.

How to spot offensive sell zones:

To know when a stock is “too extended,” you’ll need to:

- Look left on the chart to identify the base or previous consolidation.

- Measure past extensions above the 10EMA or 20EMA.

- Sell a portion (⅓ to ½) when the current move matches or exceeds those prior distances.

💡 Pro Tip: Use the Relative Measured Extension Indicator for a visual that signals when to sell into strength.

Defensive Selling: Cut Losers Before They Spiral

Offense wins games, but defense keeps you in the league.

Defensive selling is your safety net. It’s about protecting capital when the trend weakens and keeping small losses from turning into big ones.

If the price starts closing below key moving averages, it’s a sign the uptrend is stalling or reversing.

Why sell defensively?

- Avoid giving back your gains during a breakdown.

- Respect the trend instead of hoping for a bounce.

- Stay emotionally detached with rule-based stops.

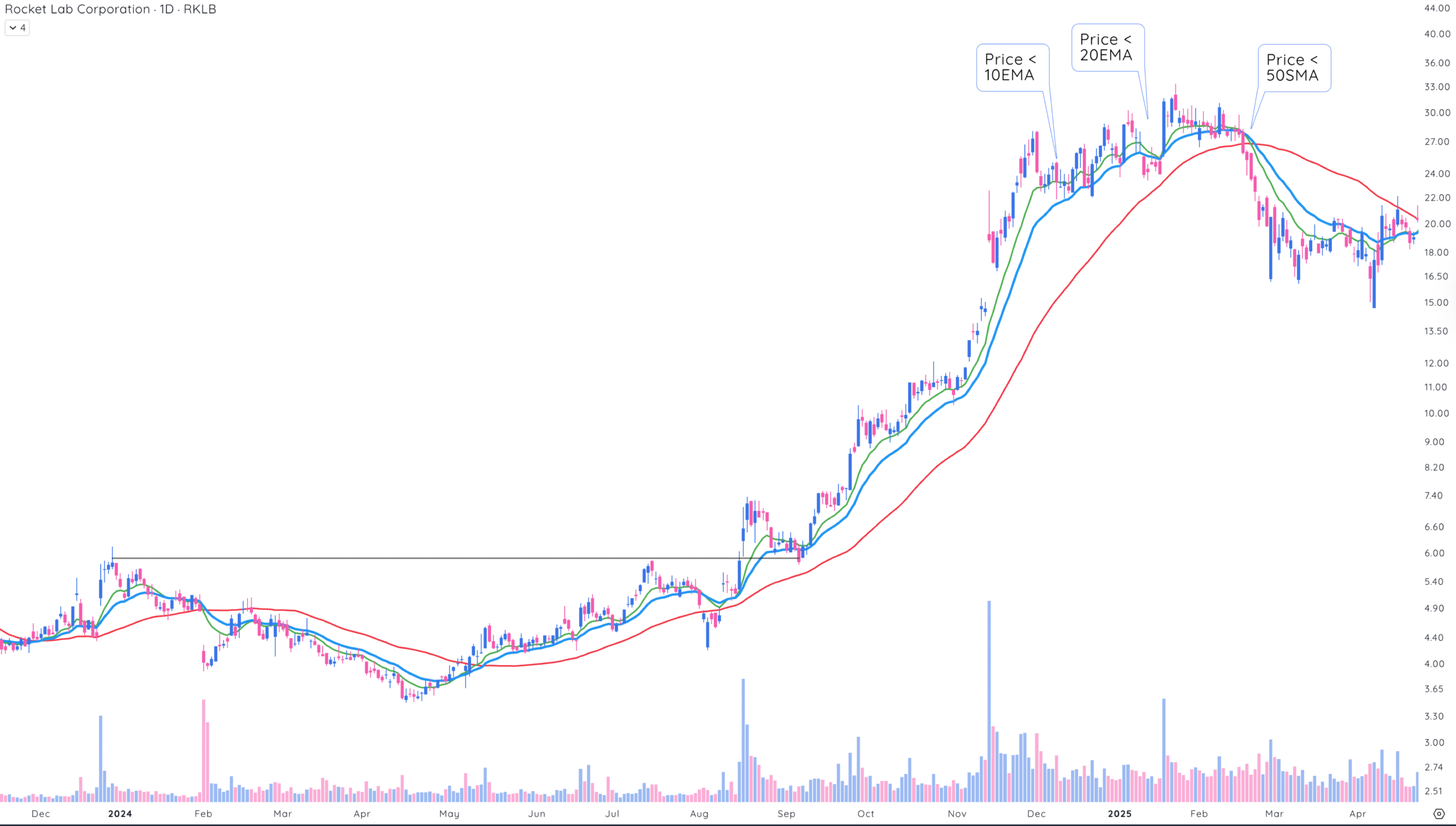

The Defensive Sell Ladder

This simple ladder helps you decide how much to sell and when based on which moving average the stock breaks below:

| Moving Average | Action |

|---|---|

| 10EMA | Sell ⅓ – early warning |

| 20EMA | Sell ⅓ – trend weakening |

| 50SMA | Exit fully – trend broken |

Here’s how it works in practice:

- A dip below the 10EMA might signal a shorter-term trend change. If it closes below the 10EMA, sell one-third.

- A break below the 20EMA signals real trend weakness. Time to trim more.

- A drop below the 50SMA? That’s usually your cue to exit the trade completely.

💡 Pro Tip: Don’t overreact to a single red day. Use the “2 closes below” rule to avoid fakeouts and stay patient when the trend is still intact.

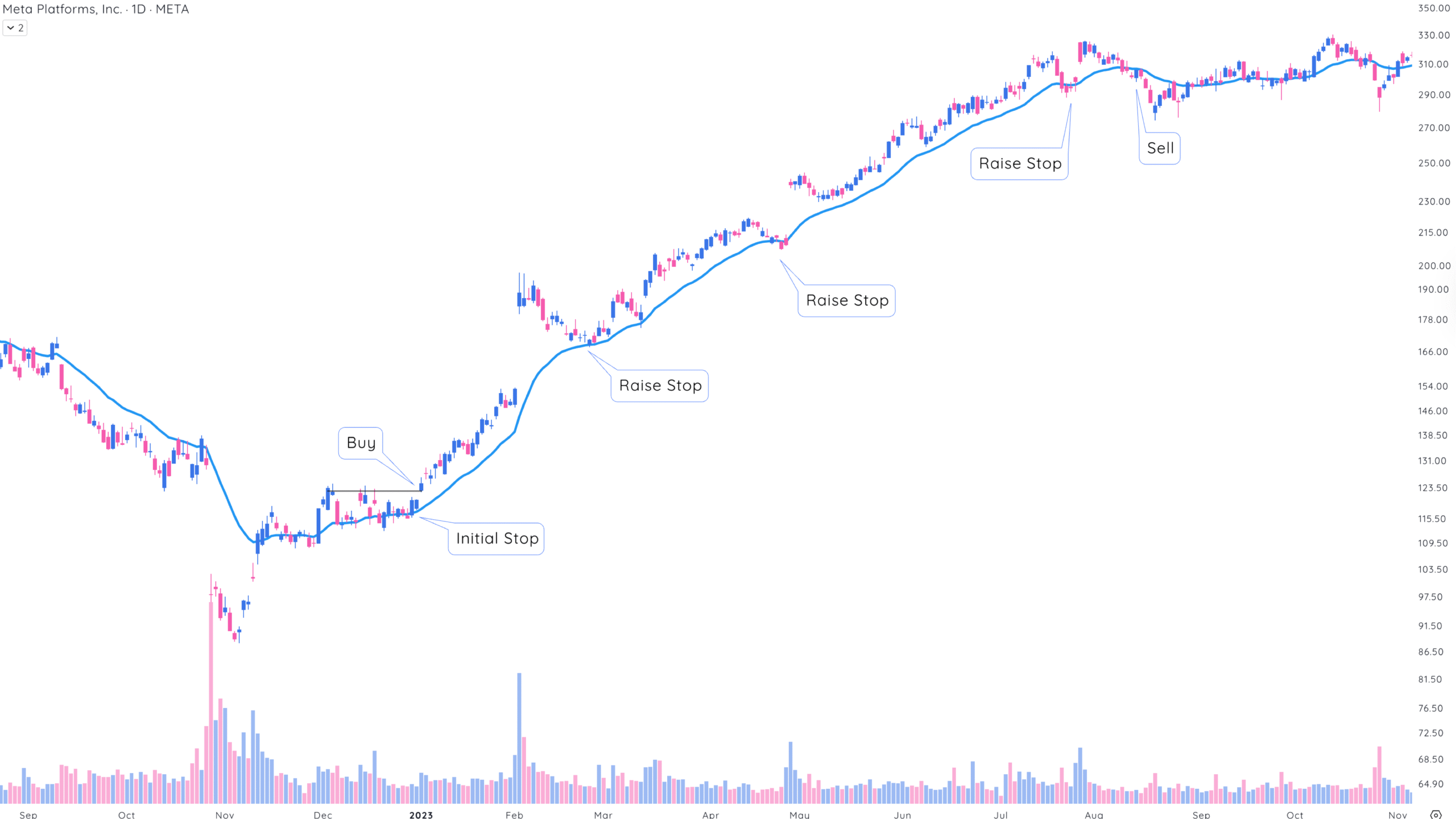

Use Moving Averages to Raise Your Trailing Stop as the Stock Climbs

Don’t use fixed stops—Let them move with the trend. This gives your trade room to breathe without giving up control. Trailing stops are your best tool for staying in strong trends without overstaying your welcome.

Follow the moving average as the trend develops. As your stock moves higher, your stop loss should follow the trend.

Moving averages rise with the stock, allowing you to ride the wave longer and only exit when the trend truly breaks.

If price keeps holding above a key moving average, like the 10EMA or 20EMA, you stay in. But if it closes below, that’s your cue to trim or exit based on your sell ladder.

Different phases of a trend require different levels of risk. A tight stop early in the move might shake you out too soon, while a wide stop late in the move could cost you gains.

Use the 10EMA early in the trend to keep losses small. When the trend builds out, switch to the 20EMA and let the trade flow through normal cycles.

Your Moving Average Sell Checklist

Final Thought: Trade the Chart, Not Your Emotions

Let’s face it—emotions can wreck a great trade.

That’s why the best traders don’t try to guess the top or hope their stock bounces back. They follow the chart, rules, and they let moving averages guide their exits just like they guide their entries.

- Use offensive selling to lock in profits while your stock still has momentum.

- Use defensive selling to protect yourself when the trend starts to fade.

- Use trailing stops to stay in strong trades longer—without giving it all back.

You don’t need to be perfect. You just need a plan.

So stop relying on hope and start relying on rules.

Let the chart tell you when it’s time to go.