Last Updated:

July 21, 2025

What is the Fundamental Rating, and why does it matter?

The Fundamental Rating is a powerful tool that helps you gauge a stock’s financial health and growth potential by digging into its core financial metrics. It uses a sophisticated weighting algorithm to rank how each fundamental factor impacts a company’s overall performance.

The fundamental rating looks at a wide range of data points, including historical and current earnings per share (EPS), sales, quarterly and annual earnings surprises, and forward-looking growth estimates.

Each stock gets a score between -100 and 100. A positive score means the company is showing strong financial momentum and likely has solid growth ahead. On the other hand, a negative score suggests weaker fundamentals and potentially limited upside.

Companies with high fundamental ratings tend to have steady earnings and sales growth, two key signs of long-term strength. These are the kinds of businesses that often attract attention from serious investors looking for the next big opportunity.

When a company shows both solid past performance and strong future potential, it’s often reflected in its stock price over time.

The fundamental rating acts like a financial compass. It helps you cut through the noise and zero in on companies that are built on strong foundations by providing traders with one simple rating.

What is Earnings Per Share?

Earnings per share (EPS) is a common metric investors look at to understand how profitable a company is. It’s calculated by taking a company’s net income and dividing it by the number of outstanding shares.

In simple terms, EPS shows how much money a company makes for each share of stock.

A higher EPS generally means the company is doing well financially. It’s making more profit for every share, which can signal strong management and solid business performance.

That’s why EPS often has a big impact on a stock’s price. Investors tend to value companies with growing or consistently high EPS.

What are Sales?

Sales, also known as revenue, show how much money a company brings in from selling its products or services. This is one of the first things investors look at when they’re trying to figure out how healthy a company’s business really is.

Think of sales as the top line of a company’s financial statement. It tells you how much cash is coming in before any expenses are taken out.

High or growing sales can be a strong sign that a company is gaining customers or increasing its market share.

Growing sales show the company’s ability to generate demand. If sales are rising, it usually means more people are buying what the company is offering.

That money can then be reinvested to fuel further growth, improve operations, or boost profitability down the road.

How strong fundamental growth affects stock moves

When it comes to big stock moves, strong fundamentals are often behind them. We’re talking about companies that are not only growing fast but are also backed by the biggest players in the market – large institutions.

Large institutions like mutual funds, pension funds, and hedge funds manage billions of dollars. When they decide to buy or sell, they can make a stock move in a big way.

These institutions don’t just guess – They have entire teams dedicated to fundamental analysis that dig deep into earnings, sales, and financial reports. And because they’re dealing with huge amounts of money, they need to accumulate shares over time.

Identifying stocks with institutional demand and getting into them early helps traders ride the trends of institutional accumulation.

Why future estimates matter

Leading stocks often show strong growth in what analysts expect for the future. That’s why forward estimates and analyst revisions play a huge role in spotting which stocks may lead the next big move.

Investors and swing traders gain an edge by tracking future earnings and sales projections. After a strong earnings report, institutions revise their future estimates based on whether the company’s growth is accelerating.

Top-performing stocks not only show outstanding quarterly and yearly growth, but also are projected to continue to grow. Triple-digit earnings today are great, but triple-digit estimates for the next quarter can be an even stronger sign of big upside ahead.

As you build your trading plan, remember the biggest winners usually have accelerating earnings and sales, both quarterly and yearly. Watching forward estimates helps confirm which stocks are likely to stay in the lead.

How Deepvue calculates the fundamental rating

Deepvue’s fundamental rating gives you a clear view of a stock’s earnings and sales strength compared to every other stock in its database.

To calculate this rating, Deepvue uses a weighted algorithm that factors in both historical and forward-looking data. This includes:

- Historical average earnings and sales growth: These figures show how consistently a company has performed over time. Strong past growth can be a good sign, especially if it’s paired with solid current performance.

- Quarterly EPS and sales surprises: Deepvue looks at whether a company has beaten analyst expectations in recent quarters. Positive surprises are a strong indicator that the company is outperforming the market’s expectations.

- Current annual EPS and sales surprises: These annual figures help highlight companies that are delivering better-than-expected results on a bigger time scale.

- Forward EPS and sales growth estimates: This forward-looking component gives insight into what analysts expect next. If the estimates are rising, it suggests that the company’s future outlook is strong, which can attract institutional interest.

A positive Fundamental Rating means the stock has strong earnings, sales, and forward estimates. A negative rating suggests weak fundamentals and a less promising growth trajectory.

When comparing stocks, this simple metric helps you quickly spot the strongest performers in the market.

Case Studies: How the fundamental rating uncovers growth

When diving into the fundamentals of stocks with high fundamental ratings, you will see huge earnings and sales numbers. Remember, stocks with triple-digit growth and accelerating earnings and sales should be at the top of your radar.

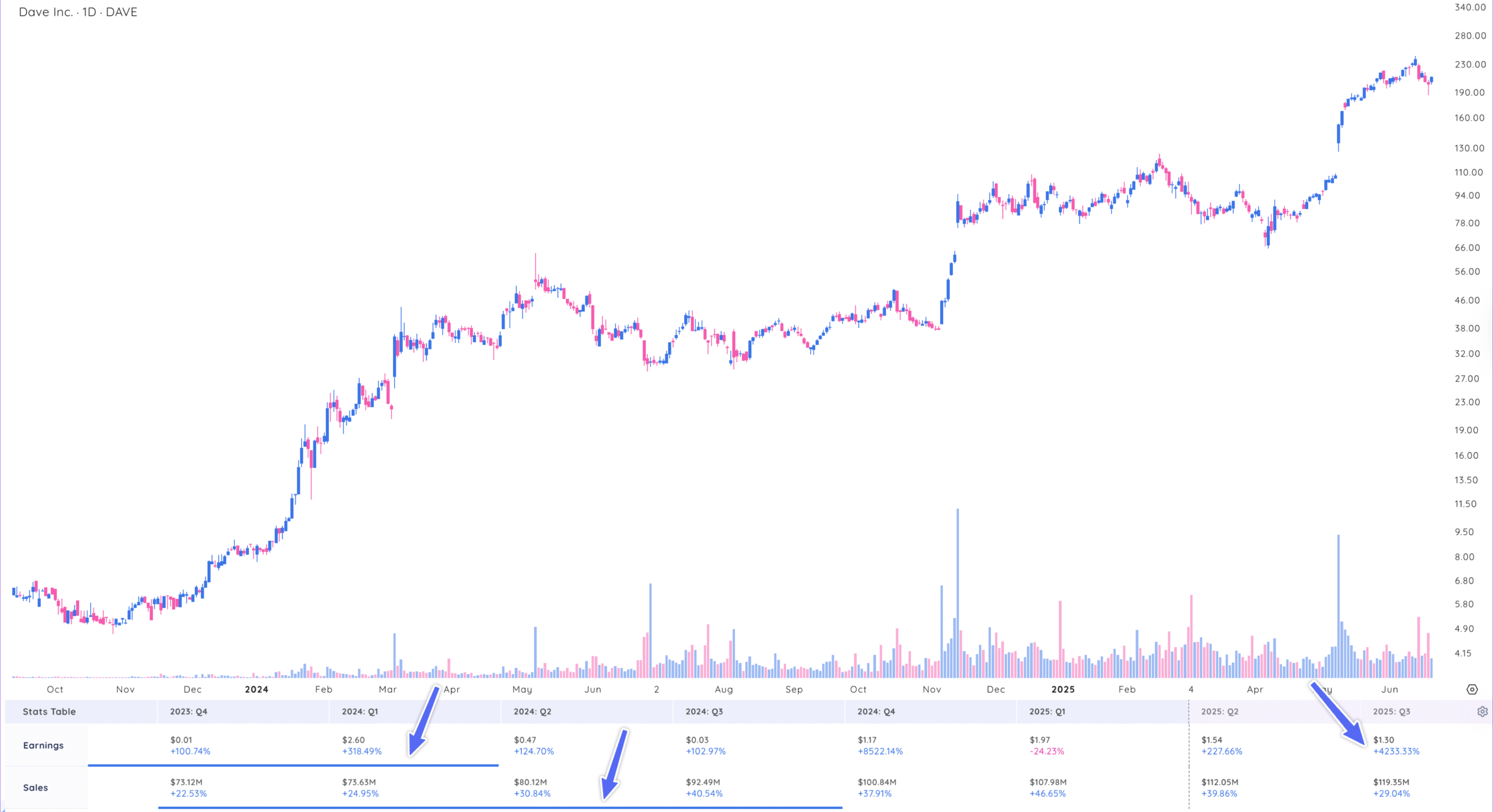

DAVE, one of the leading stocks in 2025, showed many quarters of triple-digit growth in earnings and sales. Also, note the blue bar indicating accelerating quarters. If you owned this stock, you would feel comfortable holding it longer-term, seeing future triple-digit growth estimates.

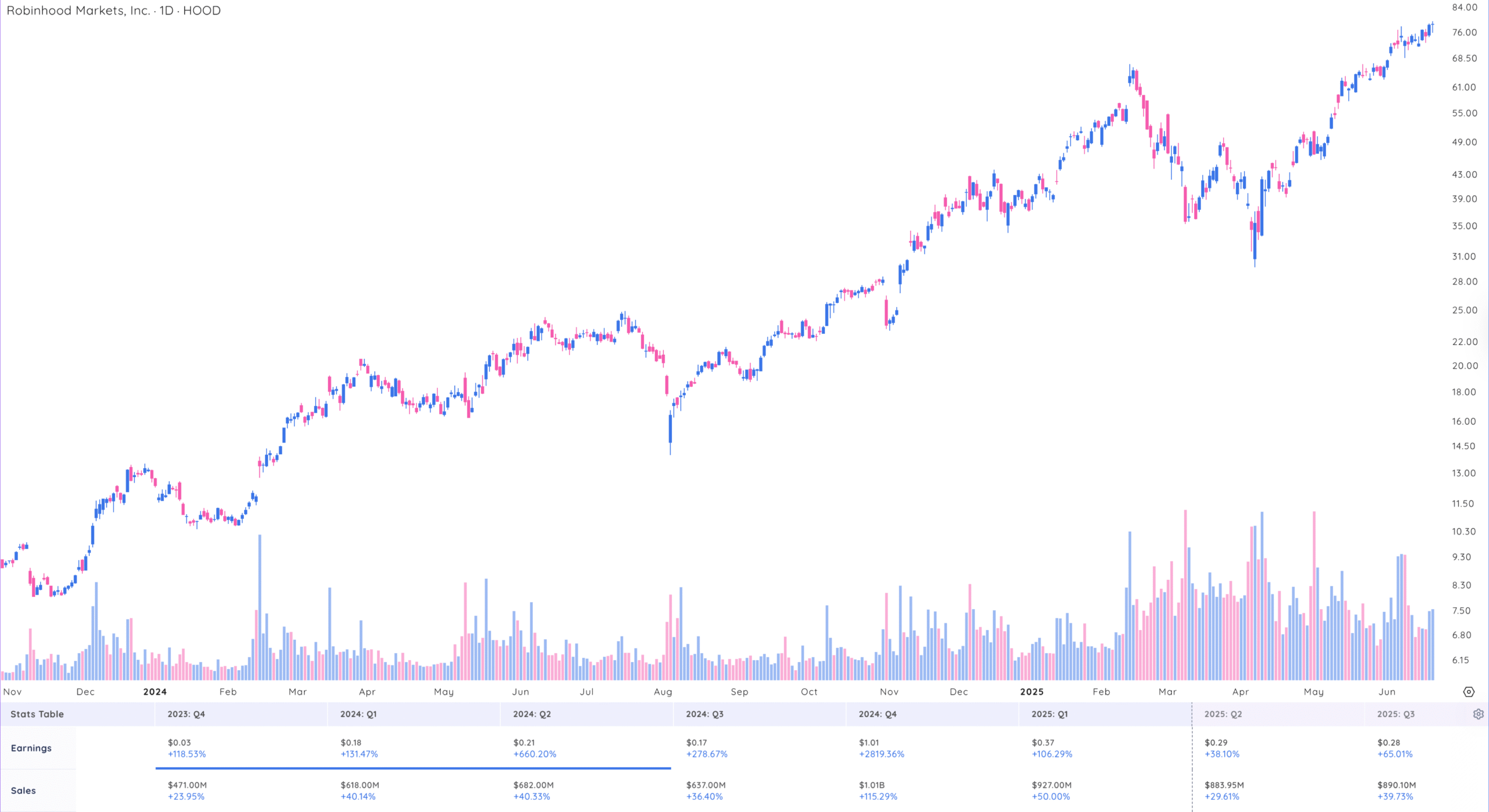

Another leading stock, HOOD, has a fundamental rating of over 90 and continues to grow its financials. When stocks with high fundamental ratings set up a technical stock pattern, don’t hesitate to act.

Screening for fundamentally strong stocks

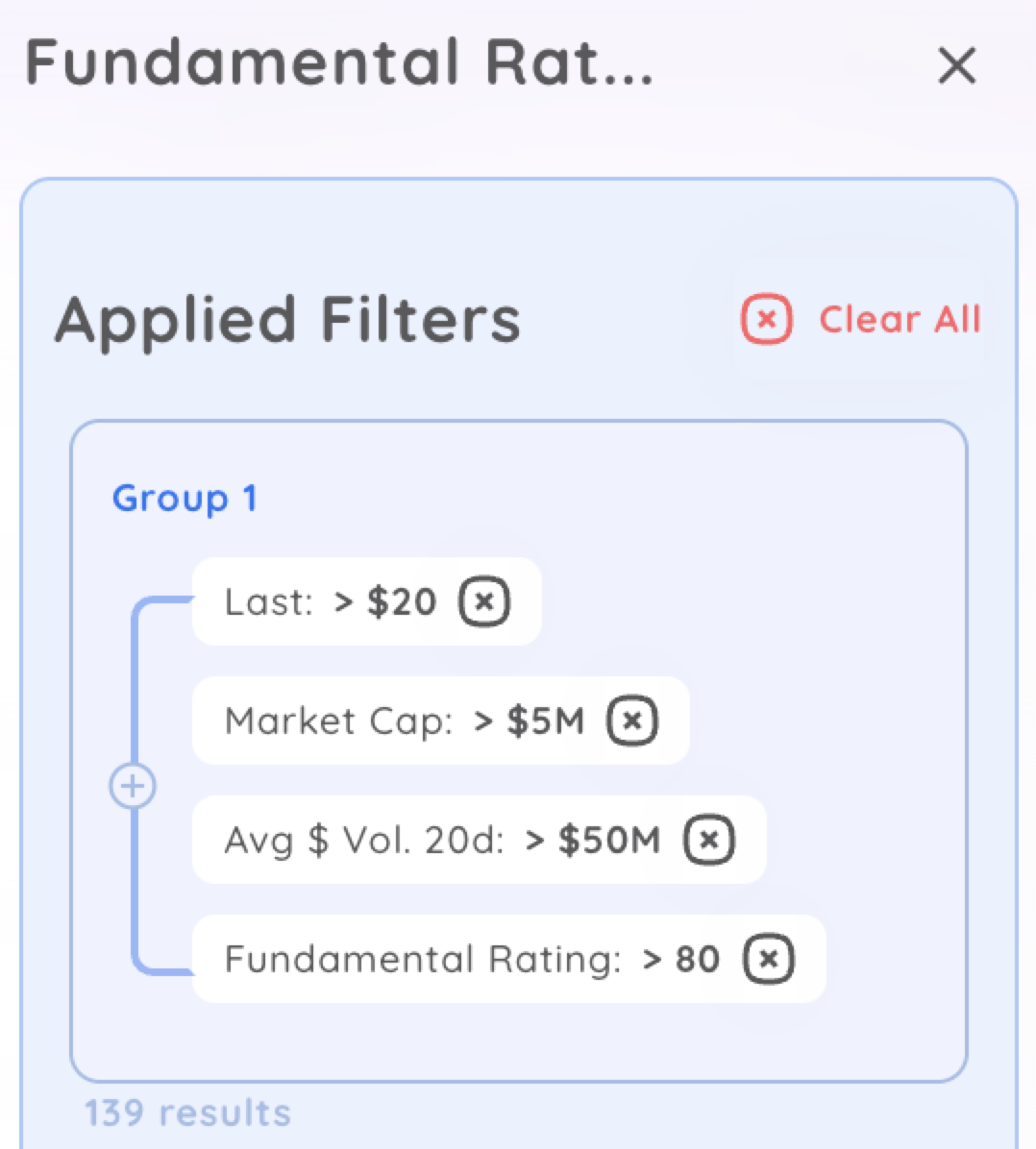

Regularly screen for stocks with high fundamental ratings to ensure you are focused on the fundamentally fastest-growing stocks.

Look for stocks with the highest fundamental ratings in addition to all your other liquidity requirements.

When thinking like an institution, insist on liquidity criteria and find the fundamentally strongest stocks.

Fundamentally strong stocks in your watchlist

Add the fundamental rating to your data panel just like any other metric in Deepvue

You can also add the fundamental rating to any of your column sets. Quickly sort by stocks with the highest fundamental rating.

Key Takeaways: Use the fundamental rating to find the strongest fundamentals

When it comes to finding the market’s biggest winners, strong fundamentals are the common thread. Companies that consistently grow earnings and sales, both in the past and in analyst projections, tend to attract serious institutional attention.

These are the stocks that often lead each market cycle.

Institutional investors move markets, and they focus on fundamentally strong, high-growth companies with solid liquidity. Identifying these stocks early helps you ride the momentum.

The Fundamental Rating simplifies stock analysis by scoring companies on earnings, sales, and future growth potential. A higher score means stronger fundamentals and a better outlook.

Earnings per share (EPS) and sales growth are essential metrics for evaluating a company’s financial health. Strong and growing numbers, with rising future growth projections, often lead to higher stock prices and attract institutional investors.

Regularly screen for high fundamental ratings to stay focused on the best growth opportunities.