Last Updated:

April 15, 2025

In a market downturn, most traders panic. But for the smart ones? This is prime time to hunt for strength. In this step-by-step guide, we’ll show you how to find winning stocks using Relative Strength inside the Deepvue platform. Whether you’re trading part-time or full-time, this system will help you consistently uncover market leaders—even on red days.

What Is Relative Strength and Why It Matters

Relative Strength (RS) isn’t just another metric. It shows which stocks are bucking the trend; moving higher when the market is pulling back. These are the stocks that often explode once pressure eases.

“The RS line doesn’t care about price; it cares about outperformance.”

In Deepvue, the RS line plots the performance of a stock vs. the S&P 500 (or other indexes). When it trends upward, that stock is outperforming. Add in custom visual cues like colored RS phases, and it’s easier than ever to spot potential leaders.

Why Relative Strength Works

Relative strength works especially well during:

- Mini Pullbacks

- Full Market Corrections

- High-Volume Down Days

Stocks that stay green when everything else turns red are telling you something. They’re being accumulated quietly—likely by institutions preparing for the next big move.

Think about it: If a stock doesn’t crumble under market pressure, what might it do when the market recovers?

Setting Up Your Deepvue Workspace

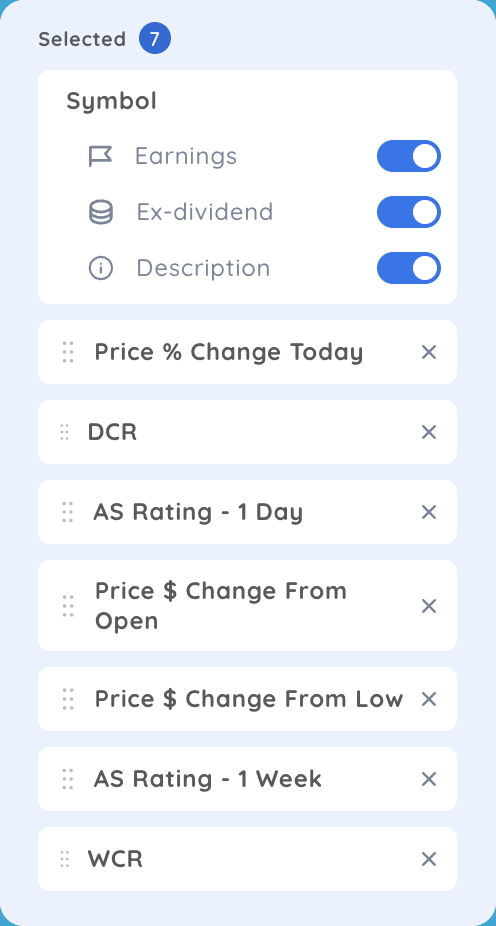

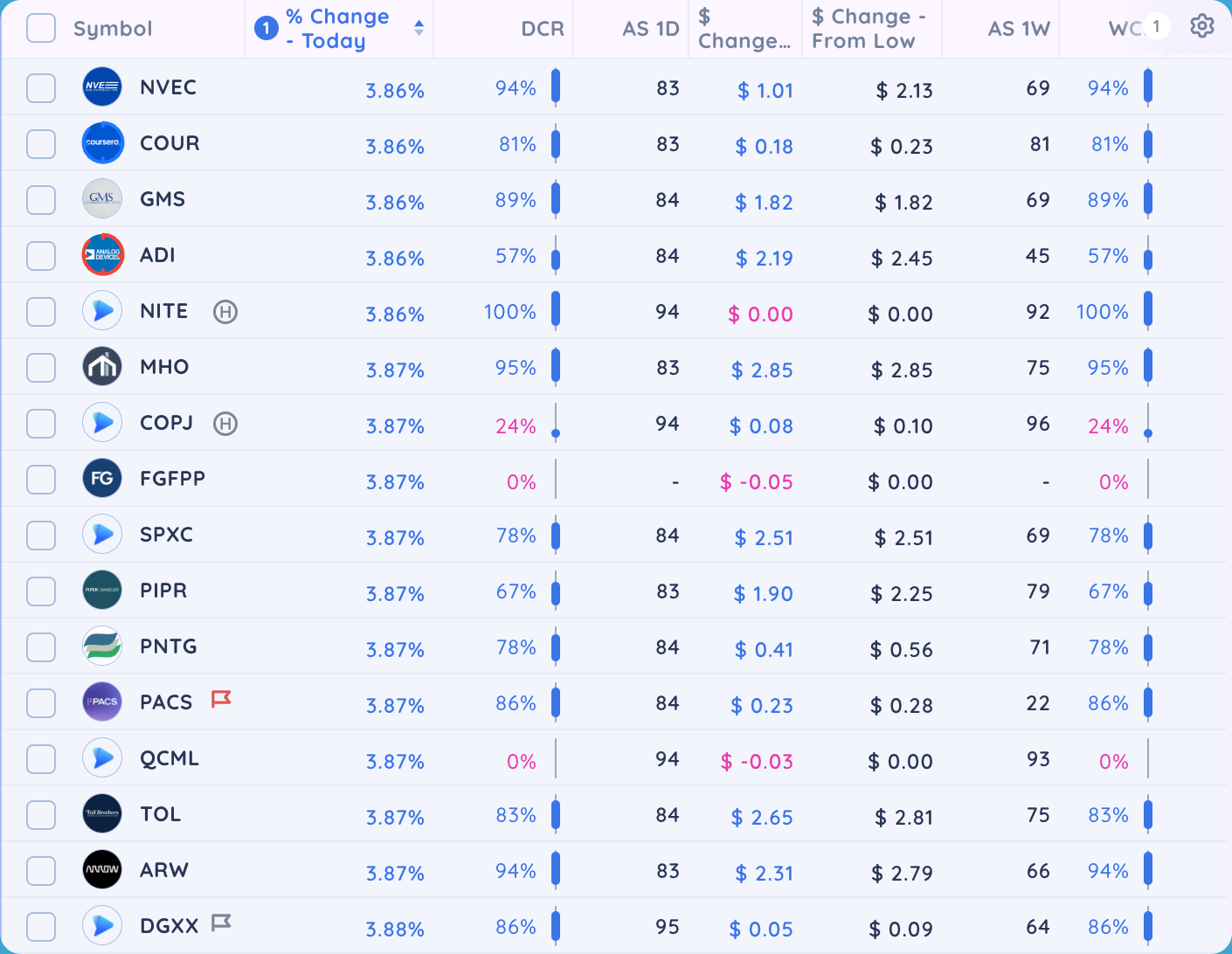

To get started, use the Relative Strength Finder column set. Here’s what it includes:

- Price % Change Today – Filters for stocks green on a red day.

- Daily & Weekly Closing Range (DCR/WCR) – Tells you where a stock closed within its daily & weekly range.

- Absolute Strength Rating (1D & 1W) – Measures RS over short time frames.

- % Change From Open/Low – Shows intraday bounce strength.

Pro Tip: Stocks that are green while the market tanks? Track them. They’re likely future leaders.

How to Identify Market Leaders on Red Days

Use this process on pullback days:

- Sort by % Change Today – Look for stocks that are up while major indexes are down.

- Check Daily Closing Range (DCR) – A DCR near 100% = strong close.

- Use % Change from Low – These stocks bounced hardest off intraday lows.

- Add to Your RS Watchlist – Track names showing up repeatedly during corrections.

A diversified portfolio, as detailed in our investment strategy guide, reduces overall risk.

The Power of Watchlists During Corrections

Corrections aren’t setbacks, they’re setups. Use this time to build your RS watchlist. The deeper the correction, the more clarity you’ll get.

If a stock keeps showing up day after day during a market pullback, it’s probably being accumulated by institutions. These are the names to watch when the trend reverses.

Developing effective trading habits is essential for consistent success in volatile markets.

Weekly RS Analysis with Deepvue

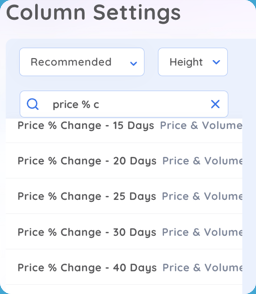

If you can’t screen daily, no problem. Use Deepvue’s Column Settings to do weekly checks:

- Sort by 20-day or 40-day price performance to find stocks leading throughout the correction.

- Identify themes using sector/ETF performance dashboards.

- Use the bubble charts to visually find top-performing stocks.

Combine Bottom-Up + Top-Down for Best Results

The magic happens when you use both approaches:

Bottom-Up: Start with stocks showing RS individually.

Top-Down: Use Deepvue’s ETF dashboards to find strong sectors.

Example:

If fintech ETFs like ARKF are leading, drill into their holdings. Use the “Holdings” feature to filter for top RS performers like SQ or AFRM.

Experienced traders analyze market trends to refine their strategies and improve timing.

Advanced Tip: Using RS Divergence & Phases

Deepvue’s RS Phases & Divergence indicator takes it to the next level:

- Positive Divergence: Stock’s RS line rises while SPY drops = powerful sign of strength.

- Negative Divergence: SPY climbs, stock weakens = caution.

- Neutral Phase: RS line mirrors SPY = stay alert, but not actionable yet.

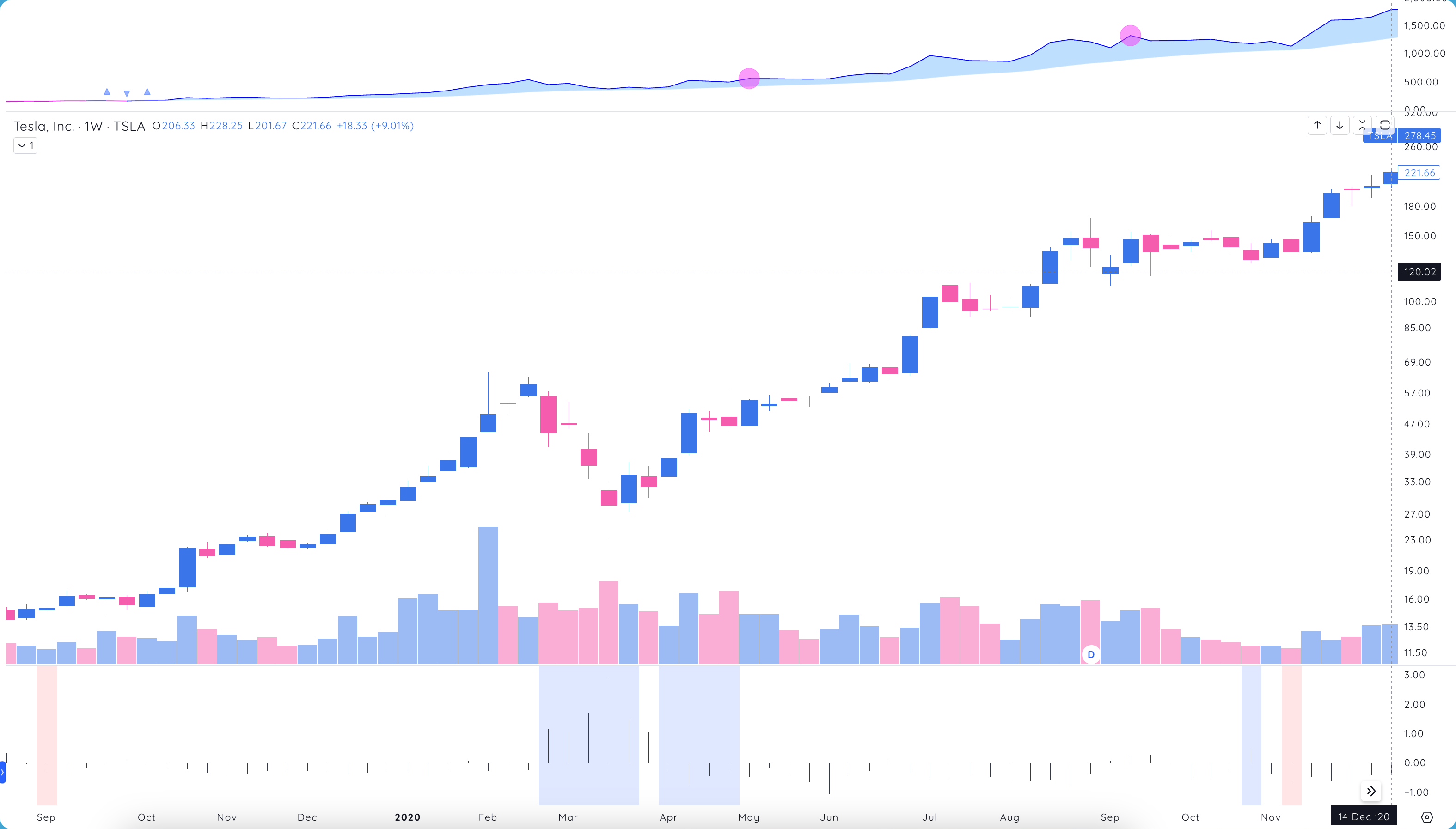

Example: When Tesla showed a positive RS divergence during the 2020 pullback, it tripled shortly after. The RS divergence signaled accumulation before the breakout.

Build Your Own Routine

Here are the simple steps to create a winning habit using Deepvue:

- Use preset screens like the Deepvue Leaders or Oliver Kell’s RS on Down Day.

- Add key columns: % change, DCR, RS Rank to your lists.

- Review themes weekly using the ETF performance chart.

- Watch divergence during market corrections.

Final Thoughts

You don’t have to chase breakouts after they’re obvious. Using relative strength and Deepvue’s powerful features, you can prepare well in advance.

Build your RS list. Watch for divergence. Stay alert for themes. And when the market flips? You’ll already have a hit list of the strongest names, ready to go.

“When you do the work during corrections, you cash in during rallies.”